A Michigan-based manufacturing consulting firm is projecting a new record high level for automotive suppliers’ capital spending on tooling: Harbour Results Inc. released the results of its study of current conditions and activity in that sector, with a prediction of cumulative spending reaching $11 billion in 2018.

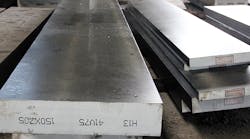

Mold tooling and die manufacturing is a high-value component of the automotive supply chain, for tier suppliers like metal formers, plastic and composite injection molding operations, die casters, and permanent mold foundries.

HRI offers operational and strategic advice and assessment programs to small- to medium-sized manufacturers, many of which are family owned or privately held. It explained that the critical factor driving tooling spend increases is the high number of North American new-vehicle program launches scheduled for 2018-2020, 177 vehicles in total.

More than this, 66% of these launches involve SUV and truck platforms, which HRI noted require more tooling to manufacturer than a car platform.

“In 2017, we are estimating tooling spend to be approximately $9 billion, which has resulted in high capacity-utilization among tool shops – 88% for die shops and 81% percent for mold shops,” stated Laurie Harbour, HRI president and CEO. “This created a new tooling model of outsourcing.

“In fact, $1 billion to $1.5 billion of tooling was outsourced this year to help manage the growing demand,” Harbour continued. “We can only expect this trend to grow in 2018.”

Looking beyond 2018, HRI projects a 40% drop in tooling spending, from $11 billion to approximately $6.7 billion in 2020.

She listed several other factors that will influence the automotive suppliers’ decisions in the coming investment cycle, including the elimination of vehicle models, new foreign-owned plants and products, OEMs’ profits (or losses), political and economic conditions, and changes in consumer preferences. These contributed to HRI’s automotive vendor tooling spend forecast of $50 billion from 2016-2021, with 2020 as the low point for spending during that time.”

HRI reported that there is a threshold of $9-10 billion for tooling investment in any given year. It noted that the North American auto industry “struggles to achieve spend beyond this threshold due to a number of factors primarily found across the OEMs and Tier 1s.”

“We conduct our annual study to help the automotive tooling industry develop better near- and long-term business strategies and to prepare for the future,” according to Laurie Harbour. “Although the predicted dip in 2020 is not nearly as significant as we experienced in the recession, it is important that tool shops continue to focus on improving operations and investing in technology during the good times to remain competitive during the dip.”