The prospect of U.S. tariffs on imports of steel is stirring new concern among manufacturers who rely on critical materials like tool steel. Representatives of the National Tooling and Machining Association and Precision Metalforming Association took those concerns to the U.S. International Trade Commission, which is evaluating anti-dumping and countervailing duties on carbon and alloy steel cut-to-length plate from Austria, Belgium, Brazil, China, France, Germany, Italy, Japan, Korea, South Africa, Taiwan, and Turkey.

In testimony this week, NTMA vice chairman Mark Vaughn stressed that high duties on tool steel imports would adversely impact U.S. tool-and-die manufacturers, and could threaten thousands of jobs.

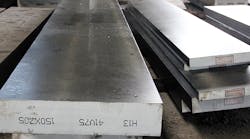

“Tool steel is used completely differently from the applications for carbon and other alloy steel plate, which is used in load-bearing and structural applications,” he said.

The issue of tariffs and duties on high-volume resources like steel typically pits domestic manufacturers against some of their customers. Steelmakers seeking relief from subsidized imported steel often seek the broadest possible application of duties and/or penalties, in order to ensure the flow of imports is effectively blocked.

Tool steel is not produced in high volume by domestic steelmakers, but may nevertheless be covered by penalites in the current matter. NTMA and PMA stressed that the three domestic producers petitioning for the ITC investigations “produce miniscule volumes and only very limited grades of tool steel,” and that the major U.S. producers of tool steel “do not produce sufficient quantities or the full range of tool steel grades and types required by U.S. purchasers.”

Steel is one of the most heavily subsidized industries in the global economy, because the global trade is conducted by numerous distributors and brokers who can help the source nation and producers gain the foreign currency that is their primary interest, and also to disguise their official role in the subsidization.

U.S. penalties on subsidized materials and goods are a renewed concern to domestic consumers of steel, in part because of the threats to fight illegal imports made by President-elect Donald J. Trump during the recent campaign. Trump frequently promised then that he'd impose 35% tariffs on Mexican imports and 45% tariffs on Chinese imports.

Tariffs on that scale could have the additional, unintended effect of forcing up consumer prices on raw materials and finished products.

Vaughn testified that because U.S. producers do not produce sufficient volumes of tool steel, and because of the specialty nature of the product, most tool steel imports do not compete with domestic- produced tool steel. He asked that the ITC continue to observe that distinction, stating “imposing high import duties on tool steel would force many of our companies and customers to reconsider whether to continue manufacturing tooling in the U.S.”

He told the ITC, “imposing high import duties on tool steel would force many of our companies and customers to reconsider whether to continue manufacturing tooling in the U.S.”