Tariffs Blamed for Weak Cutting-Tool Demand

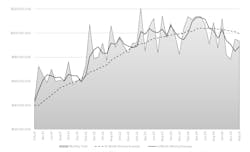

Shipments of cutting tools to machine shops and U.S. machine shops and other manufacturing businesses were nearly unchanged from January to February, dropping -0.7% to $198.6 million. Of greater concern may be the -9.2% drop in shipments from February 2024. The data from the monthly Cutting Tool Market Report functions as a reliable index to overall manufacturing activity, as cutting tools represent large consumable purchases in support of automotive, aerospace, energy, and numerous other industrial sectors.

“Orders for cutting tools in the United States continue to lag behind the numbers posted in 2024,” stated Steve Boyer, president of the U.S. Cutting Tool Institute, which compiles the monthly Cutting Tool Market Report that is the source of the shipment data, together with AMT - the Assn. for Manufacturing Technology.

“Significant declines in year-over-year totals suggest a lack of confidence in current markets,” Boyer continued. “While we have gained some clarity in our country’s leadership, the policies – specifically the full impact of imposed tariffs – cannot yet be gauged.”

The February CTMR results also show that the two-month total for 2025 cutting-tool shipments totaled $398.4 million, down -6.7% versus the same period of 2024.

“The calendar year has not kicked off well, considering the reported numbers through February, and we expect March numbers to reflect a further decline, as the tariff war has dented the confidence of manufacturing businesses around the world,” explained Tom Haag, president of Kyocera SGS Precision Tool. “The United States started this year by recovering manufacturing activity in January and February, which typically would have required the fulfillment of the supply-chain pipeline. Instead, tariff speculation has caused the opposite effect, where demand is suffering due to economic uncertainty.”

“I believe any optimism we may have had entering 2025 will be delayed until we learn more about the tariffs and their effects on the major markets we serve,” Boyer concluded.