Blame it on NAFTA or lax trade enforcement, but the “Made in the USA” journey has domestic roadblocks, too. Here’s one: the skilled workers who make the molds and tools used in automotive parts manufacturing and assembly are on the fast track to extinction.

Nearly 75% of tool and die makers are over age 45, according to data from the Bureau of Labor Statistics. Only 2% are younger than 35. Two out of five are either already eligible to retire, or will be in the next 5 to 7 years.

“When talent is in short supply in tooling, it’s in short supply in manufacturing,” Jay Baron, president and CEO of the Center for Automotive Research [CAR], told a group of leaders from the automotive industry who had gathered for two-day brainstorming session recently, on to how revive the nation’s waning tool and die sector.

The mix of attendees was certainly fertile: Manufacturing directors from most of the major automakers swapped war stories about not being able to get their orders filled with owners of six-person tooling shops who were barely keeping their doors open. Educators and academics talked about the need to meaningfully reach out to veterans, women and ex-offenders to fill the labor void, and find innovative ways to access the latest equipment to train them.

It’s been a slow and painful decline: Baron started trying to get Washington’s ear about troubles in U.S. tool and die making some 20 years ago during U.S. manufacturing’s mass exodus to China. Back then, he was “going from congressional office to congressional office, trying to explain the tooling industry in a half hour” to whomever would listen. Few did, and those who did sent him to the Pentagon because the military actually had some money to throw at the problem.

The recession of 2008 wreaked more havoc. Tool and die apprenticeship programs put in place to fill gaps in vocational education after schools dismantled their shop programs were among the first line items cut when budgets got tight. Those programs haven’t come back, says Kristen Dziczek, CAR’s Industry, Labor and Economics director.

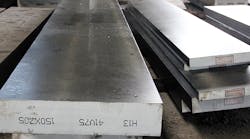

Other challenges include a lack of financing for small operations to upgrade, increasingly complex demands from OEMs, and an explosion in the diversity of materials. Advances in lightweighting and materials science mean an industry that relied on three grades of steel a generation ago now has 200 grades to choose from, along with a proliferation of aluminum, plastic and carbon fiber possibilities. Stepped-up safety regulations and emerging automotive technologies, requiring new parts and more involved configurations, are only adding to the complexity.

Alan Whitted, global head of press shops and dies at FCA and its tooling subsidiary, Autodie, said that the industry saw a 36% drop in the number of U.S. tool and die shops between 1998 and 2010. The die shops that have survived have done well at adapting to the cyclical nature of the automotive business by diversifying their services. Autodie is doing subassembly, military work, “anything we can do to help supplement those low spots in the curve.” The less cyclical the business, he said, the more good workers are attracted to it—and want to stay in it because they aren’t laid off every few years.

To develop new talent, FCA started a two-year program where die engineers gain experience in different areas of the process, and are trained on the latest technology and partnered with mentors.

Tim Marasco, global director of stamping engineering at Ford, said that if the OEMs “want to speed up with technology, the tooling industry needs to get up to speed.”

Change has been a long time coming. “This thing has been decaying for years,” he declared. “Even twenty-five years ago plus when I graduated, there was nobody going into the auto industry. It was Rust Belt, it was going offshore, it was something nobody ever thought about.”

General Motors has only one tool shop left in the U.S., in Flint. Dan Clarkson, director of GM’s Global Die & Body Center, said that of the 155 diemakers there, only five are under 40. “We’ve got 20 apprentices right now, but we agree it’s really hard to find people attracted to coming to the trades.”

Clarkson said an annual critical skills assessment and attrition survey of employees now gives him a good idea of who’s retiring in the next two years and what positions he needs to fill. College recruiting is increasingly competitive in his division, so he’s been doing more recruiting and recruiting from a wider range of universities, bringing in eager-to-learn tooling engineers from the University of Puerto Rico and welding engineers from Ferris and Ohio State universities.

James Rohde, executive director of Tianjin Motor Dies Company (TQM), the world’s largest automotive die manufacturer, shared his view of the industry from the other side of the world. The Detroit-bred Rohde invested in TQM when it was a fledgling machine shop, partnering with the Chinese owner.

Rohde sees the future of American tool and die shops as finishers for their overseas competitors who can churn out cheaper molds and tooling but lack the expertise to meet the most exacting OEM specs. TQM, for instance, contracts with small specialty die shops in the United States, including one in the Detroit suburb of Roseville called Dietech, to finish dies that its Asian plants produce.

The Asian die-makers lack the skills and deep experience. “We can build dies, but what we have in North America are the finest die shops in the world,” Rohdes said. “We aren’t at that level of perfection.”

Journeyman die-makers in the U.S. can pretty much write their own ticket, some of the speakers noted, commanding salaries of 120 to 140K.

“I think we have to show our high school sophomores and juniors that the die industry is as good as Google, as good as Apple,” said Rohde.

Laura Putre writes for IndustryWeek, a Penton publication.