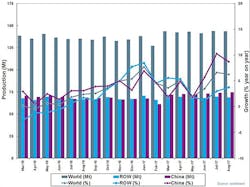

Global raw steel production totaled 143.6 million metric tons during August, down just slightly (-0.1%) from the July total and yet 6.26% higher than the August 2016 result. Through eight months of 2017, steelmakers across 67 nations tracked by the World Steel Assn. have produced 1.12 billion metric tons of raw steel, 4.76% more than the January-August 2016 total.

World Steel reports monthly raw-steel output and capacity utilization for 67 nations. Raw (or crude) steel is produced by basic oxygen furnaces and electric arc furnaces, and cast into semi-finished products, such as slabs, blooms, or billets. World Steel’s monthly report covers carbon and carbon alloy steels; data for production of stainless and specialty alloy steels are reported separately.

While the global industry is maintaining stability after two years of weak demand, the latest figures indicate capacity utilization for the 67 countries was 72.2% for August 2017. This is 0.2% less than the July rate, and 3.3% higher than the August 2016 rate.

In its recent short-term forecast of global steel demand, World Steel forecast that the current stable conditions will remain through 2018, cautioning that steel demand remains vulnerable to political and industrial-market uncertainty in the world’s major steelmaking regions, particularly in China.

The global steel market is anchored by the Chinese industry, which produces roughly half of all steel worldwide. During August, China’s raw steel production totaled 74.6 million metric tons, up slightly (0.77%) from July but 8.71% higher than last August’s tonnage. Through eight months of the current year, Chinese producers have produced 566.4 million metric tons, improving their annual output by 5.3% over the 2016 running total.Japanese steelmakers produced 8.7 million metric tons of steel last month, 1.7% more than during July but 2.0% less than during August 2016. Their YTD total of 69.6 million metric tons is slightly less (-0.4%) than last year’s January-August output.

India’s steel industry produced 8.5 million metric tons last month, 1.7% more than during July and 4.1% more than August 2016. Their eight-month output is 5.14% higher than last year’s comparable total.

In South Korea, raw-steel production during August (est. 6.16 million metric tons) remained even with the July total, but is 4.95% higher than for August 2016, and brings YTD output to 47.0 million metric tons, up 3.69%.

European steel output during August was marked by various seasonal outages, with regional production totaling 12.6 million for the month, down 10.1% from July. Even so, the latest figure is 3.5% higher than the August 2016 report, and the eight-month total stands 4.3% higher than last year’s January-August tonnage.

The largest producer nation in the region is Germany. There, August production totaled 3.6 million metric tons, up 3.1% from July and up 3.3% from August 2016. The running total for Germany’s 2017 raw-steel production is 29.4 million metric tons, up 2.1% versus the comparable figure for 2016.

The Italian steel industry’s August results reflect a seasonal outage. At 1.09 million metric tons for the month, they recorded a 48.5% drop from July – but stand nearly even (0.36%) with the August 2016 result. For the January-August period, the Italian industry has produced 15.6 million metric tons, 1.7% more than the comparable 2016 total.

Similarly, in France, August production totaling 1.13 million metric tons is 20.0% less than the July total. However, the current figure is 15.5% higher year/year, and brings the YTD total to 10.4 million metric tons, which is 11.5% more than the eight-month total for 2016.

Steelmakers in Spain produced 1.09 million metric tons of raw steel during August 2017, 9.7% more than during July but 2.67% less than during August 2016. Through eight months, their 2017 output is 2.18% higher than their 2016 running total.

Beyond the EU, in Turkey, raw steel production during August totaled 3.18 million metric tons, 4.8% less than the July total but 13.3% higher than the August 2016 total. For the current eight-month period, Turkish steelmakers have produced 24.7 million metric tons of raw steel, which is a 13.6% increase over the January-August 2016 period.

Steelmakers in Russia produced an estimated 5.6 million metric tons during August, which is essentially even (0.27%) with their July output, but 5.02% lower than the August 2016 result. Through August, the Russian industry’s raw-steel output this year stands at 46.5 million metric tons, 1.0% less than the eight-month result for 2016.

The August output from the Ukrainian steel industry is estimated at 1.8 million metric tons, which is 0.55% less than July and 5.5% less than August 2016. For the current year to-date, steelmakers in Ukraine have produced 14.1 million metric tons, or 13.9% less than their 2016 eight-month total.

The Brazilian steel industry produced 2.95 million metric tons during August, 4.4% more than during July and 1.2% more than during August 2016. Their year-to-date total is up 9.3% over 2016, to 22.5 million metric tons.

Steelmakers in the United States produced 7.064 million metric tons (7.79 million short tons) of raw steel during August, 1.47% less than during July but 6.25% more than during August 2016. The U.S. industry’s year-to-date output stands at 54.7 million metric tons of raw steel (60.29 million short tons), 2.44% more than the January-August 2016 running total.