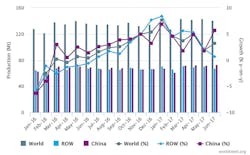

At the midpoint of 2017 the global steel industry continues a slow and steady rebound over the weak performance of recent years. Global raw-steel production in June totaled 141 million metric tons, 1.5% higher than the May total and 3.23% higher than the June 2016 result. These results may be considered even more noteworthy as in many instances the June results declines from May totals. After six months, global raw-steel production totals 836 million metric tons, 4.39% higher of the January-June 2016 total.

The data is supplied by the World Steel Assn., which reports monthly raw-steel output and capacity utilization for 67 nations. During June, raw-steel capacity utilization was 73.0% worldwide, up 1.4% from the previous month and up 1.4% than the June 2016 figure.

Raw (or crude) steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. World Steel’s monthly report covers carbon and carbon alloy steels; data for production of stainless and specialty alloy steels are reported separately.

China’s steel industry produces roughly half of the world’s raw-steel output, but after a decade or so of export-driven capacity expansion, it has embarked on a restructuring program meant to eliminate outdated capacity and refocus on serving domestic requirements.

Notwithstanding the steady rise in tonnage over recent months, World Steel maintains that the current recovery will remain modest through 2018. That is the outlook it offered in a recent mid-range forecast of steel demand, citing the effects of political and industrial-market uncertainty in the major steelmaking regions, particularly in China.

China’s steel industry, far and away the largest in the world, continues to wrestle with a series of factors, including weak domestic demand and an ongoing restructuring dictated by central planners, to eliminate outdated and surplus production capacity. Chinese steelmakers produced 419.7 million metric tons during June, 3.17% less than the May total but 5.67% more than the June 2016 results. For the current year-to-date, Chinese raw-steel production is 4.4% ahead of the six-month total for 2016.

Japan’s steelmakers produced 52.3 million metric tons during June, 2.0% less than during May and 4.3% less than during June 2016. Their YTD production total is 52.3 million metric tons, just 0.49% higher than last year’s six-month result.

In India, June raw-steel output fell 6.0% from May to 49.5 million metric tons, and that total is 1.1% less than the June 2016 result. Through the first six months of this year, Indian steelmakers have produced 49.5 million tons of raw steel, 5.3% more than during January-June 2016.

South Korean producers reported 5.9 million tons produced during June, down 1.75% compared to May but up 7.7% compared to June 2016. Year-to-date South Korean output is up to 34.7 million metric tons, 3.7% higher than last year’s six-month results.

In the European Union, raw-steel output fell 2.7% from May to 14.4 million tons during June; that total is 3.9% higher than the June 2016 tonnage, and brings the EU’s year-to-date output to 86.1 million metric tons, 4.1% higher than last year’s six-month total.

Germany has the largest steel industry within the EU, and its June tonnage totaled 3.6 million metric tons, down 2.3% from May and down 1.7% from June 2016. The YTD tonnage for German steelmakers is 1.7% higher than last year, at 22.2 million metric tons.

Italian steelmakers produced 2.1 million metric tons during June, 2.3% less than in May and 1.8% more than in June 2016. The January-June total is 12.4 million metric tons, 1.7% more than last year’s comparable figure.

In France, June raw-steel production fell 5.2% from May to 1.3 million metric tons, but that is 1.3% over the June 2016 result. Through six months of this year, French steelmakers have produced 7.9 million metric tons, 9.6% more than last year’s six-month total.

Spain’s steelmakers produced 1.3 million tons during June, 2.7% less than during May and 2.9% more than during June 2016. The YTD total in Spain is 7.3 million metric tons, 4.1% more than through six months of 2016.

Beyond the EU, Turkish steelmakers produced 3.0 million metric tons during June, 8.6% less than during May but 7.1% more than during June 2016. Over the January-June period, Turkey’s producers report 18.2 million tons of output, 11.4% more than last year’s six-month total.

In Russia, June raw-steel production totaled 5.34 million metric tons, 5.7% less than during May and 8.0% less than during June 2016. Through the first half of 2017, Russian producers’ output stands at 35.34 million metric tons, barely higher (+0.83%) than the comparable figure for 2016.

In the Ukraine, steelmakers’ June output was 1.59 million metric tons, unchanged from May but 13.0% less than the June 2016 total. For January-June of this year, the Ukraine industry has produced 10.5 million metric tons of raw steel, 15.4% less than last year’s six-month total.

The Brazilian industry reported 2.65 million metric tons produced during June, 2.25% less than during May but 4.0% more than during June 2016. Their YTD output totals 16.7 million metric tons, 12.4% more than last year’s six-month result.

In the U.S., steelmakers’ June output was 6.7 million metric tons (7.4 million short tons), 2.9% less than the May output and 1.7% less than the June 2016 output. For the January-June period, U.S. producers’ output is 40.6 million metric tons (44.74 million short tons), which is 1.34% more than their first-half tonnage for 2016.