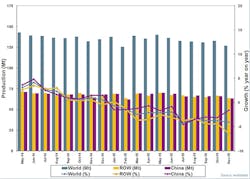

According to the World Steel Association, global raw steel output fell by 4.5%, or more than 5.9 million metric tons, from October to November, as global industrial demand continues to wane. With worldwide production totaling 126.8 million metric tons for the month, November’s result was 4.1% less than the November 2014 total.

The recent result also confirms the Association’s mid-October forecast on global steel consumption, which determined that total demand for 2015 would fall 1.7% behind the previous year’s total.

Through the first 11 months of this year, global raw steel production for the 66 countries reporting to the World Steel Assn. stands at 1.47 billion metric tons, or 2.8% less than the January-November 2014 total.

World Steel also reported that November’s global raw-steel capacity utilization rate was 66.9%, 1.4% less than the October rate and 4.0% less than the year-earlier rate.

The World Steel Association issues the monthly summary of raw (or ‘crude’) steel production and capacity utilization. Raw steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. (The monthly report includes data for carbon and carbon alloy steel; production of stainless and specialty alloy steels are not included.)

The decline in output is most pronounced in China – which regularly produces about half of all the world’s raw steel, though government industrial policy has been working to consolidate excess and higher-cost production capacity, an effort that is parallel to the ongoing decline in steel demand. For the month of November, Chinese steelmakers produced 63.3 million metric tons of raw steel, 4.2% less than during October and 1.6% less than during November 2014. For the current year-to-date, Chinese steel output is 2.2% behind the 11-month total for 2014.

Japan, the world’s second largest steelmaking nation, produced 8.7 million metric tons of raw steel last month, 2.9% less than in October and 4.7% less than in November 2014. Through November, Japanese steelmakers have produced 96.6 million metric tons, 5.0% less than a year ago.

Raw steel production in India fell 3.2% from October to November, to 7.1 million metric tons, thought that figure is nearly even (-0.24%) with the November 2014 result. For the January-November period, India’s steelmakers are just 0.2% off their 2014 pace.

In South Korea, November raw steel output totaled 5.9 million metric tons, 3.24% less than October and 0.49% less than November 2014. The year-to-date tonnage has the nation’s steel producers trailing the comparable result of last year by just 0.5%.

Total European Union (28 nations) steel output fell 5.7% from October and 7.5% from November 2014. Across the region, however, production is only 1.5% behind the 11-month result of 2014.

In Germany, the EU’s largest producer and among the largest steel-producing nations in the world, November tonnage fell 4.33% to 3.48 million metric tons, a total that is 3.0% less than last November’s result. For the current year, German steelmakers have produced 39.7 million metric tons of raw steel, virtually even with the 2014 report.

Italy’s raw steel production was 1.9 million metric tons during November, down 2.1% from the previous month by up 0.4% compared to November 2014. Year-to-date steel production in that country is down 7.8% compared to 2014, to 20.5 million metric tons.

In Spain, raw steel production fell 3.6% from October to 1.2 million metric tons during November 2015, a figure that is down 2.9% compared to November 2014. The nation’s 11-month output is up 3.7% over last year, however.

French steelmakers produced 1.2 million metric tons during November, 0.84% more than in October, but 14.7% less than during the same month last year. For the January-November period, the nation’s industry off the year-ago pace by 6.8%.

Turkey has emerged as one of the world’s ten largest steelmaking nations, but November’s raw steel production of 2.6 million metric tons was 5.12% less than the October total and 7.2% less than the November 2014 result. Year-to-date, Turkish steelmakers are 8.0% behind their 2014 pace.

Steelmakers in Russia produced 5.7 million metric tons of raw steel during November, down 1.8% versus October and down 3.1% versus November 2014. The 11-month result for steelmaking in Russia is 65.2 million metric tons, 3.1% less than the comparable year-ago total.

Ukrainian producers had an output of 1.9 million metric tons of raw steel during November, 8.4% less than during October but 3.1% more than during November 2014. Their year-to-date total is now 21 million metric tons, a result that is 16.8% behind the January-November 2014 figure.

Brazilian raw steel production fell 14.6% from October to November, and the total of 2.5 million metric tons represents a drop of 4.4% from November 2014. The year-to-date raw steel output is 1.9% behind the 2014 rate at 30.8 million metric tons.

Finally, U.S. steel industry produced 6.1 million metric tons of raw steel in November 2015, 6.99% less than during October and 15.6% less than November 2014. With 73.1 million metric tons of steel produced to-date for 2015, the domestic industry is 9.7% behind last year’s 11-month total, and may be in line to lose its third-ranking among global steelmaking nations to India