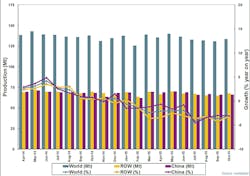

Steel production ticked up 2.0% from September to October, finishing the month at 133.6 million metric tons, and ending four consecutive months of declining output. However, the total is 3.12% less than the October 2014 result, suggesting the short-range outlook for falling global demand issued last month is already having an influence in production plans.

More telling, the global steel output for January through October 2015 is now 1.34 billion metric tons, 2.5% less than during the comparable period of 2014.

That forecast, as well as the October production data, is supplied by the World Steel Association, which represents steelmakers in 66 countries and tracks raw steel, or ‘crude steel’, output and capacity utilization. Raw steel is the product of basic oxygen furnaces and electric arc furnaces and cast into semi-finished products, such as slabs, blooms, or billets. (The monthly report includes data for carbon and carbon alloy steel; production of stainless and specialty alloy steels are not included.)

While steel production increased 2.0% worldwide from September to October, global steel capacity utilization declined 1.0% to 68.3%. That figure is 3.4% lower than October 2014 capacity utilization rate.

China remains the most important steelmaking nation, regularly producing roughly half of all raw steel in the world. For October 2015, China’s raw steel output, essentially even (up 0.01%) with the September total but down .3.1% compared to October 2014. For the current year, China has produced 675.1 million metric tons, 2.2% less than the nation produced for January-October 2014.

Japanese steelmakers produced 9.0 million metric tons of raw steel in October, nearly 5.0% more than in September but 3.8% less than in October 2014. For the January-October period, Japan’s industry has produce 87.8 million metric tons of raw steel, 5.1% less than the 10-month result for 2014.

In India, October steel output was 7.5 million metric tons, 3.29% more than the September result and 4.87% more than the October 2014 output. Through the first 10 months of this year, the Indian steel industry has produced 75.07 million metric tons, 3.3% more than the comparable result for 2014.

South Korean steelmakers produced 5.8 million metric tons last month, 3.3% more than during September but 5.58% less than during October 2014. The country’s 10-month tonnage total is 57.7 million metric tons, down 3.6% versus the January-October 2014 total.

In Europe, steel production across the EU’s 28 nations increased 5.06% from September but is 3.8% lower than the October 2014 figure.

Germany is the largest steelmaking nation in Europe, and one of the largest in the world. Its October tonnage was 3.64 million metric tons, up 7.74% from September and up 2.7% from October 2014. The nation’s year-to-date steel output is 36.2 million metric tons, up just 0.3% compared to the same period of 2014.

Italian steelmakers produced 1.87 million metric tons during October, down 10.18% from September and down 8.6% from the October 2014 total. For the current year, the nation’s steel output is 18.6 million metric tons, a year-on-year decline of 8.8%.

French steel output during October 1.2 million metric tons, declining 6.4% from September, and 20.9% less than the year-ago total. For the year-to-date, French raw steel production has totaled 12.8 million metric tons, 6.0% less than the 10-month total for 2014.

In Spain, October raw steel output was 1.25 million metric tons, 2.0% less than during September and 3.1% less than during October 2014. The year-to-date result is 12.6 million metric tons, 2.2% less than the comparable figure for 2014.

Russian steelmakers produced 5.7 million metric tons of raw steel during October, 3.1% less than during September, and 2.4% less than during October 2014. The year-to-date total is virtually unchanged (-0.2%) from last year.

In Ukraine, October raw steel production was 2.1 million metric tons, up 0.36% from September and up 6.4% from October 2014. The January-October total is 19.1 million metric tons, down 18.3% from last year’s result for that war-torn industry.

The Brazilian steel industry produced 3.0 million metric tons of raw steel during October, an increase of 19.3% over September, but a decrease of 2.3% versus October 2014. The year-to-date total for that country is 28.3 million metric tons, or 1.3% less than last year’s 10-month result.

Finally, U.S. steelmakers produced 6.739 million metric tons (7.4 million tons) of raw steel during October, 2.8% more than during September and 6.2% less than during October 2014. The January-October total is 67.2 million metric tons (74.1 million tons), which is off the pace set last year by 8.8%.