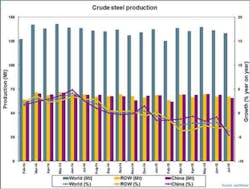

Primary steel production decreased 2.2% worldwide from June to July, totaling 133 million metric tons in the latest month. That figure also represents a 3.8% decrease compared to the July 2014 result, and brings the current year’s total raw steel volume (January-July 2015) to 948 million metric tons.

It is the fifth monthly decline of the current year, and the cumulative total indicates a decline of 1.85% compared to the comparable seven-month period of 2014.

All the figures are supplied by the World Steel Association, the trade association for steelmakers in 65 nations. Its monthly report includes production and capacity utilization data for raw steel — the output of basic oxygen furnaces and electric arc furnaces, prior to alloying and casting into semi-finished products, such as slabs, blooms, or billets. World Steel Assn. results include data for carbon and carbon alloy steel output. Stainless steels and other specialty alloy steels are not included.

The global raw-steel capacity utilization rate for July 2015 was 68.4%, a drop of 3.8% from June’s rate, and of 4.2% from the July 2014 rate.

In China, July steel output slipped 4.5% from June’s tonnage to 65.8 million metric tons. While still the world’s largest steelmaking nation by far, China’s producers are enduring the effects of the central government’s effort to eliminate outdated and excess steelmaking capacity, as well as the broader effects of reduced stimulus spending to maintain growth in that economy. The current monthly tonnage represents a 4.6% decline from the July 2014 result, and brings the China’s year-to-date raw steel production to 476 million metric tons — 1.22% less than the January-July 2015 total.

Elsewhere in Asia, Japanese raw steel output rose 3.6% from June to July’s 8.8 million metric tons, though that total represents a 4.9% year-to-year (July 2014) decline. For the current year, Japan’s producers have totaled 61.4 million metric tons of raw steel, down 4.8% versus the first seven months of 2014

In South Korea, July raw steel production rose 3.4% from June to 6.06 million metric tons, a result that also improves 1.7% over the July 2014 tonnage. However, for the year-to-date South Korean steel production of 40.6 million metric tons has fallen 3.94% behind the pace set during January-July 2014.

Steel production across the European Union (28 nations) fell 4.2% from June to July, though the latest month is nearly even (+0.32%) with the July 2014 tonnage, and the year-to-date tonnage (101.9 million metric tons) is +0.32 compared to the seven-month total for 2014.

Germany, the largest producer nation in the region and the world’s seventh-largest producer nation, July 2015 raw steel production was 3.6 million metric tons, down 4.1% from June but up 4.7% from July 2014. The seventh-month total for German raw-steel production is 25.76 million metric tons, down slightly (-0.66%) from January-July 2014

Italy is the region’s second-largest steel producer, and its July output (1.85 million metric tons) was down 3.65% from June, and down 11.64% from July 2014. The year-to-date output (13.6 million metric tons) is 10.73% behind the seven-month result for last year.

Among the EU’s other larger producers, July raw steel output in France (1.4 million metric tons) increased 2.96% from June but fell 1.44% from July 2014; and in Spain tonnage fell 21.45% from June but just -1.04% from July 2014.

Beyond the EU, Turkey’s raw steel production for July 2015 was down 10.74% from June, to 2.5 million metric tons. That represents a 10.4% decline from July 2014, and brings Turkish YTD production to 18.73 million metric tons, 6.3% less than the comparable seven-month result for 2014.

Russian steelmakers produced 6.0 million metric tons of raw steels during July, 6.6% more than during June but 2.8% less than during July 2014. The year-to-date raw steel output is nearly even (+0.23%) with the January-July 2014 tonnage at 41.7 million metric tons.

The Ukrainian steel industry produced 1.9 million metric tons of raw steel during July, a 6.67% drop from the June result and a decrease of 24.1% compared to July 2014. The year-to-date tonnage is down 26.8% in that war-plagued country.

The Brazilian steel industry produced 2.87 million metric tons raw steel during July, 3.6% more than the June output and 3.1% less than the July 2014 total. For January-July 2015, Brazil’s steel industry is 1.2% ahead of the 2014 pace.

Finally, U.S. steelmakers’ July 2015 output was 6.98 million metric tons (7.69 million short tons), 2.14% more than the June result but 9.12% less than the July 2014 output. Year-to-date, U.S. steelmakers have produced 46.97 million metric tons (51.77 million short tons) – which is 8.45% less than the January-July total for 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.