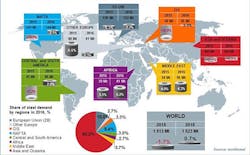

The World Steel Association released a short-range global outlook (2015-2016) for steel demand, forecasting the current year’s total at 1.513 billion metric tons, a decline of 1.7% versus total 2014 demand. For 2016, the forecast sees global steel demand growing 0.7% to 1.523 billion metric tons.

The trends depicted in the outlook have been in progress for most of the past two years, including the leveling off of the Chinese industrial economy, the uneven recovery in the European market, and slow growth in the U.S. economy.

Other factors (e.g., the Russian-Ukrainian conflict) also have disrupted demand in traditionally industrial economies. When it released a short-range outlook for global steel consumption in April, World Steel pegged the current year at 1.544 billion metric tons, rising to 1.565 billion metric tons in 2016.

“It is clear that the steel industry has, for the time being, reached the end of a major growth cycle which was based on the rapid economic development of China,” observed Hans Jürgen Kerkhoff, chairman of the Worldsteel Economics Committee, which conducted the research. “Combined with China’s slowdown we also face low investment, financial market turbulence, and geopolitical conflicts in many developing regions.

“The steel industry is now experiencing low-growth,” he continued, “which will last for the time it takes for other developing regions of sufficient size and strength to produce another major growth cycle.”

The forecast determined that the deceleration in the Chinese economy has been “more severe than expected,” adversely impacting that nation’s construction and manufacturing sectors. As such, China’s steel demand is seen decreasing 3.5% in 2015 and a further 2.0% in 2016. Steel demand in China appears to have peaked in 2013, and the forecasters noted “an increasing risk” associated with China’s economic slowdown.

The market volatility resulting from that decline is now a global concern, according to Worldsteel Economics.

In the world’s developed economies (mainly the EU and U.S.), the economic growth that seemed to begin in 2014 weakened considerably in 2015. The study called U.S. economic fundamentals “solid,” but it said steel demand in the U.S. would decline in 2015 due to currency appreciation and a slowing energy sector.

In the EU, economic recovery is being helped by low oil prices, low interest rates, and a weak euro. In Japan and South Korea, there the forecasters identified structural weakness in the economies weighing on the expansion prospects.

In the developed economies, steel demand is forecast to decline 2.1% this year but then expand by 1.8% is expected in 2016.

Global steel demand - excluding China - will decline 0.2 % in 2015, then grow by 2.9% in 2016

"We expect the current headwinds to moderate in 2016 but this is based on a belief that the Chinese economy will stabilize,” Hans Jürgen Kerkhoff said. “Of particular concern is the vulnerability of the emerging economies to external shocks though we are also expecting some, like India, to show resilience to the global slowdown. On a positive note, the recovery of steel demand in the developed economies, even though the momentum has weakened a little, remains on track.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.