Domestic manufacturers’ new orders for machine tools and related products increased 12.6% from May to June, rising from a revised May total of $360.18 million to $405.73 million. There was no improvement in the year-on-year result, however, as the latest month falls 2.1% behind the June 2013 order total.

Double-Digit Drops in Machine Tool Orders

Solid Increase in June Cutting Tool Orders

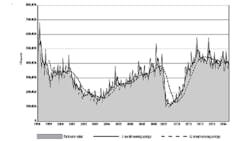

The June figures bring the six-month total for 2014 machine tool orders to $2,349.38 million, meaning the year-to-date orders stand at $2,349.38 million, down 2.7% compared with the January-June 2013 total.

The results are found in the latest U.S. Manufacturing Technology Orders report, a monthly summary of nationwide and regional machine tool orders compiled by the AMT – the Association for Manufacturing Technology. The USMTO program monitors demand for metal-cutting equipment and metal forming and fabricating equipment, both domestically sourced and imported products, with the combined figure representing the monthly total.

“Order gains in June were driven by two factors,” observed AMT president Douglas K. Woods, ”the end of the quarter and continued strength in key customer industries, especially automotive, aerospace, medical and energy.

“What really warrants attention, however, is a rise in the average value of orders, as this suggests manufacturers are making investments in greater productivity as well as capacity,” Woods continued. “Our forecasts suggest continued moderate growth throughout the rest of the year and going into 2015.”

North Central East Region Leads Results

“Moderate growth” may not eliminate the up-and-down month-to-month demand that has characterized manufacturing technology demand orders since late 2012. In addition to the nationwide total, the USMTO program collects results of new orders from six U.S. regions, offering a view of different market conditions. Because of changes among AMT’s survey participants over the past year, year-on-year comparison for Metal Forming and Fabricating is not accurate across all regions, so that some results are not reported and different references are available from region to region.

In the Northeast, AMT reported June 2014 metal cutting tool orders totaled $55.41 million, 2.0% less than in May, and overall manufacturing technology orders were $57.71 million, down 12.8% versus the year-ago total of $66.19 million. January-June total orders for the region were $362.78 million, down 7.9% versus the comparable six-month period of 2013

The Southeast region had June 2014 metal cutting tool orders totaling $30.17 million, which is a 2.6% decline from May, but a 29.7% decline from June 2013. With total manufacturing technology orders of $214.05 million for the first six months of 2014, demand in the Southeast is down 0.8% compared to January-June 2013.

In the North Central-East region, June manufacturing technology orders rose 48.4% during June, totaling $119.32 million, versus May’s $80.43 million. The new result also represents a 7.5% improvement over the $111.00 million reported for June 2013. The region’s year-to-date manufacturing technology orders now total $667.29 million, 5.9% higher than the first-half totals for 2013.

The North Central-West region had total manufacturing technology orders amounting to $82.90 million during June, up 47.8% compared to May’s $56.10 million; and up 8.6% compared to the June 2013 total of $76.36 million. For the year-to-date, the region’s total orders are reported to be $454.78 million — of which metal cutting equipment orders are $433.64 million, and that total is off by 15.0% versus the comparable figure for January-June 2013.

The South Central region’s metal cutting tool orders during June slipped 22.2% from May, down to $79.63 million, and total manufacturing technology orders in the region slipped 5.7% in the June-to-June comparison. For the year-to-date, the South Central has total manufacturing technology orders of $371.96 million, virtually even (-0.2%) with the results for the same period of 2013.

Finally, in the West region AMT reports that June’s metal-cutting equipment orders declined to $54.72 million, -5.9% from May, but up 2.1% from June 2013. Metal-cutting equipment orders in the region are now $349.38 million for the year-to-date, up 1.5% versus the January-June 2013 total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.