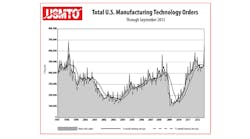

New orders for machine tools and related products rose 38.5% during March, up to $492.78 million from February’s revised total of $355.88 million. The current result is also slightly ahead (2.9%) of the March 2013 result.

The new data brings the 2014 total to $1,228.6 million, 0.9% higher than the first-quarter 2013 total, and seem to align with recent results from Germany and Italy indicating stronger demand from manufacturers in those markets.

These domestic results are drawn from the latest U.S. Manufacturing Technology Orders (USMTO) report, a monthly summary by AMT - The Association for Manufacturing Technology. AMT tracks nationwide orders for metal-cutting equipment separately from metal forming and fabricating equipment, both domestically sourced and imports, with the combined figure representing the monthly total. Results are provided for six geographic regions as well.

The monthly results are based on the totals of actual data reported by companies participating in the USMTO program.

“As these figures indicate, along with strong readings for the PMI (purchasing managers’ index), durable goods orders, and motor vehicle sales, manufacturing continues to be a leader in economic growth,” according to AMT president Douglas K. Woods.

He continued: “It’s noteworthy that this was the strongest month for orders since September 2012, an IMTS month, though order delays caused by a harsh winter certainly interrupted the flow of business at the start of the year. As we head toward IMTS 2014, we expect continued expansion through the rest of this year and likely into 2015.”

Variations Across Regional Results

The regional results showed some wide variations in the February-to-March rebound. (AMT tracks new orders in six regions, though changes among the survey participants over the past year mean that the year-over-year comparison for Metal Forming and Fabricating equipment is not accurate across all regions, so the March report is adjusted to take this change into consideration.)

In the Northeast, manufacturers ordered $67.49 million worth of machine tools and related technology, up 5.5% from February’s $63.96 million, but down 3.8% from the March 2013 total of $67.74 million. The regional year-to-date total is $173.82 million, up 23.6% from January-March 2013.

In the Southeast, new orders for metal-cutting equipment rose 28.1% from February to $29.44 million, which is also 9.6% higher than in March 2013. The 2014 year-to-date manufacturing technology orders in the Southeast totaled $106.13 million.

In the North Central-East region, March manufacturing technology orders totaled $200.33 million, up 145.1% from the February total of $81.75 million, and up 42.2% over the March 2013 total. The region’s year-to-date 2014 total is $370.20 million, up 4.8% from the total for January-March 2013.

In the North Central-West region, new orders for metal-cutting equipment rose 20.% from February to March, to $67.35 million, though the total was down 24.9% from March 2013. The year-to-date total for all manufacturing technology in the region is $237.59 million through March.

In the South Central region, new orders for metal-cutting equipment totaled $63.01 million during March, down 3.7% from February’s result, $65.43 million; and down 1.1% from the March 2013 result, $63.69 million. The region’s Q1 total for 2014 is $179.07 million.

Finally, in the West region, the new orders for metal-cutting equipment slipped 0.6% from February, from $54.10 million to $53.80 million, and fell 28.8% from the March 2013 result. The West region’s January-March 2014 total for metal-cutting equipment orders is $180.85 million, up 9.2% versus the first-quarter result for 2013.