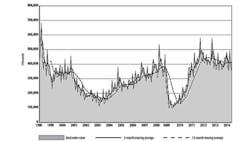

U.S. manufacturers ordered $351.93 million worth of machine tools and related technologies during May, 10% less than the total value of orders for April and 17.5% less than the $426.40 million recorded for May 2013. It’s the second consecutive month to show a decline in orders, and the fourth monthly decline over the first five months of the current year.

The total value new orders for January-May 2014 now stands at $1.97 billion, or 1.4% less than the comparable five-month total for 2013.

The results are contained in the latest U.S. Manufacturing Technology Orders report, a monthly summary of nationwide and regional machine tool orders compiled by the AMT – the Association for Manufacturing Technology. The USMTO tracks orders for metal-cutting equipment separately from metal forming and fabricating equipment, both domestically sourced and imported products, with the combined figure representing the monthly total.

The May results extend the wavering pattern of demand for manufacturing technology, a sequence that has persisted over nearly seven quarters of activity.

“Expectations for the 2014 manufacturing technology market were for a soft first half of the year, followed by a stronger second half,” observed Douglas K. Woods president of AMT – the Association for Manufacturing Technology. “The fluctuations seen in the past few months are on track with forecasts, and all indications are that U.S. manufacturing activity is and will remain strong.”

Woods noted that the Institute for Supply Management’s Purchasing Managers Index (a monthly review of several manufacturing sectors) continues above ‘50’, the breakeven point indicating economic expansion rather than recession, and he cited rising manufacturing capacity utilization rates. And to these points he added that “both auto sales and aerospace backlogs are growing, all indications that our customers’ businesses are healthy. We expect continued investments in capital expansion through year’s end.”

In addition to the national total, the USMTO includes results from six U.S. regions, offering a view of different market conditions. Because of changes among AMT’s survey participants over the past year, year-on-year comparison for Metal Forming and Fabricating is not accurate across all regions, so that some results are not reported and different references are available from region to region.

Regional Results are Spotty

In the Northeast, new orders for metal-cutting equipment in May declined 6.7% from April to $56.6 million, which is down 28.9% versus the May 2013 total. Year-to-date, the combined metal-cutting and metal-forming equipment orders in the Northeast through May totaled $337.42 million, 2.9% more than the region’s January-May 2013 total.

In the Southeast, new orders for metal-cutting equipment in May fell 33.2% from April, totaling $29.4 million, which is 26.7% less than the May 2013 total. At $180.61 million, the combined metal-cutting and –forming equipment orders in the Southeast for the January-May period rose 5.5% versus the comparable figure for 2013.

The North Central-East region recorded new orders totaling $81.83 million during May, down 16.8% from April’s $98.42 million result, and down 16.7% versus the May 2013 figure. For the first five months of this year, the North Central-East region’s new order total is $551.42 million, up 6.2% compared with the same figure for 2013.

In the North Central-West, May orders for machine tools, etc. fell 17.8% to $53.70 million, down 27.2% compared to May 2013’s total of $73.76 million. The year-to-date order total for metal-cutting equipment $286.06 million, a 20.3% decline against the January-May 2013 total.

The best results for May were to be found in the South Central region, where metal-cutting equipment totaled $74.38 million, a 22.2% improvement over April’s total, and a 20.6% improvement over May 2013. The region’s year-to-date total for all equipment types is $313.77 million, up 0.9% compared with the January-May 2013 total.

Finally, the West region’s metal-cutting equipment orders declined 5.6% from April to May, settling at $53.48 million, but that total is down 17.7% versus May 2013. The year-to-date metal-cutting equipment total in the West region is $291.14 million, down 0.1% compared to the January-May 2013 total

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.