U.S. Machine Tool Orders Improved During August

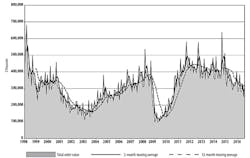

U.S. manufacturers’ new orders for machine tools totaled $336.58 million during August, rising 34.4% over the July figure and 15.9% over the August 2015 total. The report precedes by one month the anticipated boost in new orders coinciding with the International Machine Tool Show (IMTS) 2016, staged in September, and thus suggests some sustained improvement in demand for manufacturing technology.

The figures are drawn from the monthly U.S. Manufacturing Technology Orders report, compiled and presented by AMT – the Association for Manufacturing Technology. The USMTO report summarizes actual totals for machine tools, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

AMT describes USMTO data as a reliable leading economic indicator, as manufacturing companies invest in capital equipment to increase capacity and improve productivity.

Over the past two years, new orders have been inconsistent and mostly below expectations. Weak demand in the energy-related industries have been particularly problematic for manufacturing technology suppliers. In June, AMT set aside its previous forecast anticipating a Q4 2016 upswing in manufacturing demand, and later announced that current market forecasts indicate total new orders for 2016 will finish lower than 2015. AMT’s current position is that “a full-fledged market comeback (is) not expected until the second half of 2017.”

As of August, 2016 year-to-date orders were $2.43 billion, a 12.8% decline versus the January-August 2015 report.

“This was the first time since March 2015 that we saw growth in all six regions that we track for this report,” stated AMT president Douglas K. Woods. “Much of the growth came from smaller, contract machining shops, a sign of greater activity and capacity constraints in larger industries. Automotive and aerospace also made gains after some faltering. These are possible indicators that our market has hit its bottom and is signaling a comeback, albeit slowly.”

In the Northeast region, new orders for metal-cutting equipment increased 24.3% from July to August, to $58.36 million in the latest month. The new figure is 14.2% higher than the August 2015 result, and brings the region’s year-to-date total for metal-cutting equipment to $469.69 million, 12.7% lower than last year’s eight-month total.

The Southeast region reported metal-cutting equipment orders of $68.07 million, 66.8% higher than the July result and 49.2% higher than the August 2015 result. The region’s year-to-date total for metal-cutting equipment is now $323.19 million, 18.3% higher than the total for January-August 2015.

In the North Central-East region, total manufacturing technology orders for August rose 64.4% from July to $82.84 million. That figure is 3.0% higher than the August 2015 result. For the first eight months of this year, the North Central-East region has recorded new orders for manufacturing technology $600.21 million, 21.4% lower than the comparable figure for 2015.

In the North Central-West region, new orders for metal-cutting equipment totaled $56.82 million during August, 16.9% higher than during July and 15.7% higher than during August 2015. The year-to-date total for the region’s metal-cutting equipment orders is $434.12 million, 16.2% lower than last year’s eight-month total.

In the South Central region, new orders for metal-cutting equipment rose 37.9% from July to August, finishing the month at $18.9 million. That total is 51.1% higher than the August 2015 figure, and it brings the year-to-date total for South Central regional metal-cutting equipment orders to $147.96 million, 31.1% lower than last year’s eight-month figure.

The West region reported August metal-cutting equipment orders at $47.57 million, 21.0% higher than the July figure and 7.0% higher than the August 2015 figure. The January-August total for regional metal-cutting equipment orders is $392.06 million, 7.2% lower than the region’s eight-month total for 2015.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.