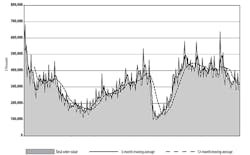

U.S. manufacturers’ new orders for metal cutting and metal forming/fabricating equipment declined just 1.4%, from April to May, to $277.74 million. After weak manufacturing demand for much of the past two years, the narrowness of the decline is encouraging machine tool-builders’ hopes of recovery.

However, the May result is the lowest monthly new-order volume of the current year (and the lowest month total for machine tool orders in over two years), and the total continues to trail the results of last year. The May total shows an 18.2% decline versus the May 2015 figure. Similarly, the May result brings the year-to-date total for manufacturing technology orders to $1,512,260, which is 16.7% lower than the January-May 2015 total.

These figures are drawn from the monthly U.S. Manufacturing Technology Orders report issued by AMT – the Association for Manufacturing Technology. The USMTO report summarizes actual totals for machine tool orders reported by participating companies that produce and distribute metal-cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment.

USMTO is used as a forward-looking indicator of manufacturing capital investment, similar to the Institute for Supply Management’s Purchasing Manager’s Index (PMI) — as companies place orders for new equipment to increase capacity and to improve current capabilities.

“Overall we are seeing improved sentiment from manufacturing technology providers, as certain key industry sectors are indicating signs of growth – in particular agriculture, which has been stagnant for an extended period, and a resurgent aerospace industry,” stated AMT president Douglas K. Woods.

AMT: "... Economy looks healthier"

“The general economy looks healthier with an especially strong jobs report for June and improved consumer sentiment,” Woods continued. “With the latest PMI coming in at 53.2, we’re optimistic that the elements are coming together for recovery in manufacturing and the manufacturing technology market over the next several months.”

The USMTO program also reports monthly new-order activity for metal-cutting and metal-forming and fabricating equipment, in six regions of the U.S., and the regional variations during May illustrate the different circumstances for manufacturing demand. In the Northeast region, new orders for metal-cutting equipment during May fell 2.1% from the April figure, to $52.64 million. That figure is down 15.6% from April, and brings the year-to-date total for the region to $290.20 million, which is 15.8% lower than the Northeast result for January-May 2015.

In the Southeast region, new orders for metal-cutting equipment rose 15.4% from April to May, to $33.8 million. That figure also improved on the May 2015 result by 5.1%, and the region’s total manufacturing technology orders for the first five months of this year now stand at $190.49 million, which is 16.9% higher than last year’s comparable figure.

In the North Central-East region, total new orders for manufacturing technology fell 6.6% from April to $61.81 million, which is 29.4% lower than the May 2015 order total. For January-May 2016, the North Central-East regional order total is $380.1 million, 25.5% lower than last year’s comparable total.

The North Central-West region reported total manufacturing technology orders of $62.96 million for May, 25.5% higher than April, and 3.8% higher than May 2015. The region’s year-to-date new-order total for metal-cutting equipment is $275.63 million, down 20.9% compared to January-May 2015.

The South Central region’s May new-orders total for metal cutting equipment is $15.95 million, 24.6% lower than the April figure and 33.2% lower than the May 2015 result. The region’s total new orders for the first five months of this year stand at $97.97 million, down 35.0% over the 2015 figure.

In the West region, new orders total for metal cutting equipment during May fell 11.1% from April, $47.07 million. That represents a 31.3% decline from May 2015, and the West’s January-May total order volume for manufacturing technology is $261.3 million, down 7.8% versus the figure for the first five months of last year.