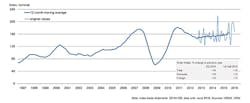

Major economic indicators are positive and prospects for continued growth are solid, according to the second-quarter 2016 report by the German Machine Tool Builders’ Association (VDW.) The trade association, which represents the largest machine-tool design and manufacturing industry in Europe, and one of the largest industrial sectors in the German economy, reported Q2 new orders rose 16% year-over-year, with strong increases from both domestic (+19%) and foreign (+14%) customers.

New orders from within the Euro Zone increased by 37% of the 2Q increase, and orders from non-Euro Zone nations increased 10%.

Overall, during the April-June period, new orders increased 12% compared to the Q2 2015 period, and while VDW members’ domestic new orders rose by 10%, orders from abroad were also up by 13%.

The trend seems to overtake VDW’s forecast from earlier this year, that 2016 economic growth would be slow and nominal for the machine tool sector.

“The year’s second quarter … signals a green light for an overall rise in orders during the current year. Our business is running significantly better than we expected at the beginning of the year. The sector can point to a sound, balanced performance over the year’s first half,” according to VDW executive director Dr. Wilfried Schäfer.

The higher level of demand results mainly from a strong domestic business conditions, but more particularly from the development of new automotive manufacturing projects in China and Mexico. This explains the simultaneous, substantial rise in orders in both domestic orders and exports.

In regard to new orders during the first half of 2016, one-time events are primarily responsible for solid improvement in the industry’s fortunes. From abroad, manufacturers of machine tools (horizontal and vertical machines, and turning machines) are benefiting in particular from large-scale orders. All other metal-cutting technologies, as well as major categories of forming technology, are performing less well in terms of orders from abroad.

Domestically, by contrast, the picture is somewhat different. According to Schäfer, “Metal-cutting is 2% up, and the current as-is situation gives reason to hope that a broad spectrum of technologies can benefit from this.”

VDW members’ revenues during in the first half of 2016 ended up slightly better than even. “In view of the encouraging development of orders in the year’s first six months, and the range of order backlogs, now recovered to over seven months, we are anticipating a perceptible rise in turnover for the upcoming period,” Schäfer said.

He added that this analysis is conditional on demand levels remaining stable during the second half of this year, particularly in the domestic market. Germany’s industrial sector is in good shape, with strong and competitive price structures, VDW noted. “Despite Brexit, the business cycle is holding up well, and showing no significant signs of deterioration,” according to Schäfer.

Employment levels remain high in the German machine-tool sector (69,000 employees in May, +1% versus May 2015), indicating that German machine tool manufacturers, despite cyclical fluctuations, are well set to face challenges in the future. “The sector is entering the year’s second half in improved condition, and is continuing to invest in qualified staff,” Schäfer said.