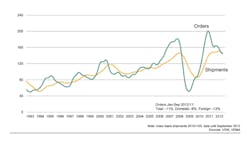

Weak industrial activity in the European Union continues to test German machine tool builders. The industry recorded a 4% decline in third-quarter new orders for their products, with domestic orders falling 12% versus the 3Q 2011 result and export orders remaining even with last year’s figure. The information was supplied by the German Machine Tool Builders’ Association (VDW), which noted that stable exports of machine tools have been the industry’s strength during 2012.

Machine tool building is one of the largest segments of that country’s mechanical engineering industry, and one of the most successful of all nationality groups in the global manufacturing technology industry. For the month of August, VDW indicated that German machine tool builders had about 68,640 employees, up 4.5% compared with August 2011..

Previously, VDW reported its members’ new orders fell 20% in the second quarter and 7% in the first quarter, versus the respective 2011 periods.

For the year-to-date, new orders for German machine tools have declined 11% versus the January-September 2011 period, as domestic orders dropped 8%, and export orders fell by 12%.

“The fall in demand over the course of the year has so far proceeded in line with expectations”, stated Dr. Wilfried Schäfer, executive director of VDW.

Among the largest export markets for machine tools, VDW noted that the North American industry has demonstrated rising demand, mainly in the U.S. The third quarter of 2012 covered the period of IMTS 2012, the year’s largest trade show for manufacturing technology. Recently, the VDW’s U.S. counterpart reported September 2012 was among the strongest months in history for machine tool purchases.

“There is substantial investment ongoing here, not least from the automotive industry and the aviation sector,” VDW stated.

VDW also noted that Asian demand levels are returning to “business as normal” after high growth rates over recent years. In China, the largest Asian market for machine tools, demand has cooled due to stricter financial regulations that are making financing more difficult for small and midsized companies.

Western European demand remains weak, according to VDW, though Eastern European markets, notably Russia, are more encouraging destinations for VDW members.

As for German domestic demand, it had been more reliable through the first half of 2012. “In the two most recent months, by contrast, our biggest customer grouping, the automotive industry, had put its foot firmly on the brake pedal, and is postponing capital investment projects with its component suppliers,” Schäfer commented. Even so, the association maintained that demand in Germany has held up better than in other European nations.

VDW observed that its members’ production of machine tool rose 12% during the January-September 2012 period, giving confidence that its outlook for new orders will exceed previous forecasts. “Against the background of the order trends, a continuingly high order backlog of more than eight months with practically complete capacity utilisation, the VDW is upping its production output forecast for 2012 from its previous 6 to 8%,” stated Schäfer. This would correspond to sales of almost €14 billion ($17.8 billion), approaching the record figure set in 2008.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.