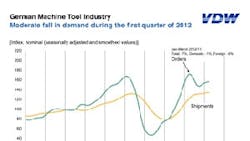

Machine Tool Orders Down 7% in Q1, VDW Reports

German machine tool builders’ first-quarter 2012 new orders fell 7% overall versus the first quarter of 2011, according to a report by the German Machine Tool Builders’ Association (VDW). Domestic orders were down just 1%, while “orders from abroad” dropped 9% against the early 2011 figure, which VDW said had been a historic high. Although the group had forecast a fall in demand late last year, and reported in February that demand dropped 4% in the fourth quarter, it now indicates that new orders were “holding up” in view of the ongoing debt crisis in the Euro zone.

“European demand, too, is still looking good,” according to Dr. Wilfried Schäfer, executive director of the VDW.

The German machine tool industry is one of the largest industrial segments in that country, and is important as a source of new technology as well as new production equipment to many manufacturers. Its 2011 revenues were an estimated $16.9 billion. VDW member companies’ order backlog stood at 9 months as of February 2012, “a similar level to October of last year,” the group stated. Their capacity utilization rate is at 95.1% as of April 2012, which it said is nearly unchanged from a year ago.

“The German machine tool industry is still performing well. By reason of the order backlog, a rise in production output for 2012 is virtually assured,” Schäfer predicted. The group is forecasting a 5% rate of growth for the year. Though demand is slowing, he added, this has already been factored into pricing, and will give the member companies latitude to address strategic issues, e.g., expanding operations in Asia.

As of February 2012, VDW companies were employing 68,200 people, up 6.4% from February 2011.

“Capacity utilization is still holding up well in Germany’s industrial sector, which is investing in additional capacities for coping with its orders,” according to Schäfer.

In particular, VDW noted that German demand for forming technology has had a stabilizing effect on the nation’s economy. Forming technology is an indicator of long-term economic strength because of the machinery’s function in automotive and other manufacturing segments. Orders for forming technology in the first quarter of 2012 rose 20%, according to VDW.

Schäfer acknowledged a declining rate of new orders for German machinery from Southern European countries, and cited the debt crisis as the reason. However, he said orders from Scandinavia, the U.K., and France have continued to place new machine tool orders at a steady rate.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.