Global Uncertainty Sinks German Builders’ 2Q Orders

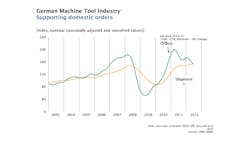

Germany’s Machine Tool Builders Assn. (VDW) reported its members' second-quarter new orders fell by 20% overall compared to the same period of 2011. However, the unwelcome result is largely the effect of weak global demand, according to VDW: domestic orders fell by 8%, while orders from abroad were 26% down versus 2Q 2011.

In the first six months of 2012, machine tool bookings fell by 13% compared to the April-June 2011 period, and during the first half VDW found domestic orders fell 6% over the preceding year while export orders fell 17%.

In May VDW reported its members found an overall 7% decline in machine tool orders for the first quarter of 2012.

“The months April to June have shown that the machine tool industry cannot disengage from global macro-economic developments,” stated Dr. Wilfried Schäfer, executive director of the VDW, in Frankfurt am Main.

However, Schäfer added that the second quarter of 2011 saw the steepest rise in export orders for the entire year, so that the comparatively high decrease in orders from abroad also reflects a ‘base effect.’ For second half of 2012, VDW forecast orders from abroad will stabilize, and this may represent approximately twice as much volume as the domestic market.

The German machine tool industry is among the five largest sectors in that country’s mechanical engineering industry, and develops production technologies for all manner of metalworking applications. Just as important, Germany’s machine tool builders have a broad customer base that relies heavily on exports. The automotive industry and its component suppliers, in particular, are investing in new model years and new, cost saving drive technologies. “The moderate fall in orders during the year’s second quarter is attributable to ‘one-off effects’ from large orders for forming technology,” VDW stated.

Correspondingly, the 8.4-month order backlog in June 2012, following 8.7 months in February, remains very high. Plants are running at close to full capacity. Recently, in fact, the capacity utilization figure has risen slightly, from 95.1% in April to 96.9% in July.

The German machine tool industry’s employment total increased by more than 6% over the year’s first five months, now totaling 68,590 employees in all.

“Although the macro-economic situation has become significantly more problematical in recent months, due to the euro debt crisis and its effects on the global economy, and investors are unsettled, machine tool production output is set to keep on growing this year,” said Schäfer.

The VDW is forecasting 6% growth in production outputfor the remainder of 2012.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.