Late Improvement Helped Machine Tool Orders in 2013

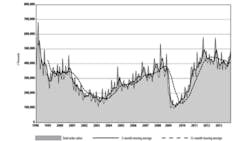

U.S. machine shops and other manufacturers ordered $491.89 million worth of new machine tools and related technology during December 2013, giving 2013 a strong ending. December’s new orders brought the 2013 total for orders to $4.94 billion, a decline of 5.1% over the 2012 total, which is in line with the range of comparative results throughout 2013.

The figures are contained in the final U.S. Machine Tool Orders report for 2013. AMT – The Association for Manufacturing Technology compiles the monthly report based on actual data for metal cutting equipment and metal forming and fabricating equipment, as reported by participating companies.

“With a strong finish to 2013 for manufacturing technology orders, plus strong reports for durable goods, capacity utilization, and PMI, there is plenty of favorable momentum for the industry going into 2014,” stated AMT president Douglas K. Woods.

Woods’ comments suggested a possibility of strong end-of-year purchasing decisions by manufacturers aiming to fit new equipment into capital-spending programs for the past year. “The average age of corporate fixed assets is at almost 22 years, and interest rates are historically low,” he continued. “This one-two punch is creating a ripe atmosphere for investment in capital equipment, which we anticipate will translate into more great news for manufacturing growth.”

The data for December improved on the November results by 9.9%, and also represented a rise of 11.8% over the December 2012 total.

Full-Year Declines in Four of Six

The USMTO data covers nationwide results as well as new manufacturing technology orders in six regions. In the Northeast, new orders for machine tools and related products fell to $65.47 million for the month of December, down 13.5% from November, and down 2.5% compared to December 2012.

The total results for 2013 in the Northeast region rose 4.7% over 2012, finishing at $808.79 million.

In the Southeast, December orders for metal-cutting equipment were up 11.6% versus November’s total, however the full-year results for all machine tool equipment trailed 2012’s total by 16.7%, finishing 2013 at $452.20 million. (Year-on-year data for metal forming and fabricating equipment in this region and three others is incomplete, AMT noted, due to changes in survey participants; the overall data has been adjusted to reflect the change, but four regions’ reports do not reflect the total of orders in the most recent month.*)

In the North Central East region, December new orders rose 11.3% from November to $138.82 million, and that result also was up 37.8% from the December 2012 figure. For the full year, the region’s new orders totaled $1.287 billion, down 3.0% versus the comparable 2012 figure.

The North Central West region posted new orders for metal cutting equipment orders* of $98.84 million, up 34.4% from November, and up 1.6% from December 2012 results. The region’s total machine tool orders for 2013 were valued at $924.26 million, down 10.1% from the 2012 result.

The South Central region’s December metal cutting equipment orders* were $73.14 million, up 11.1% from November, and up 26.7% from December 2012. The 12-month result for all machine tool orders was $749.06 million, down 13.2% from the 2012 total.

Finally, in the West regional metal cutting equipment orders* were $67.06 million, up 1.0% from November and up 18.0% from December 2012. Total manufacturing technology orders in the region for 2013 rose 6.6%, finishing 2013 at $718.37 million.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.