U.S. Machine Tool Orders Rose in December, Edged Up for 2012

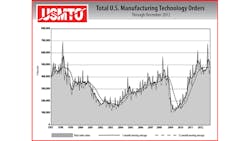

Domestic manufacturers closed 2012 with a solid showing of new orders for machine tools and related components, bringing the year to a close with a slight improvement over the previous year. December orders were valued at totaled $499.43 million, 17.8% above the November total, but down -9.4% from the December 2011 result.

All the results are included in the latest United States Manufacturing Technology Orders (USMTO) report, a series released by AMT, and based on actual data reported by participating companies. The monthly report covers all orders for manufacturing technology, both domestically built products and imported ones.

The December total brought the full 12-month result for 2012 U.S. machine tool orders to $5.706 billion, a gain of 2.6% on the full year total for 2011, $5.6 billion. The final month’s USMTO report showed another rebound in the monthly activity, which had peaked and dipped throughout 2012. The highlight for 2012 was in September, which included the results of IMTS 2012, the biennial trade show, which drove total sales to $674,234 million.

“Finishing 2012 with the highest order total in 13 years certainly confirms the renaissance of U.S. manufacturing,” stated Douglas K. Woods, president of AMT - The Association For Manufacturing Technology, the trade association representing U.S. machining operations and machine tool manufacturers and distributors. “This also shows the resilience of the industry in the face of GDP contraction in the fourth quarter, along with fiscal and political concerns that have been overshadowing much of the general economy.”

Regional results confirm pattern

The USMTO also covers machine tool orders on a regional basis. In the Northeast, new orders rose 10.1% in December, up to $74.02 million from $67.24 million for November. That new figure was off the region’s December 2011 pace by -25%, however, and the 12-month results totaled $789.38 million, -9.0% off the Jan.-Dec. 2011 total ($867.5 million.)

The Southern region posted new orders totaling $78.11 million in December, up 19.1% from November’s $65.58 million — but down -25% from the December 2011 result ($98.70 million.)

The South’s annual result was positive however, rising 12.2% to $835.28 million in 2012, from $744.33 million for all of 2011.

The Midwest region posted December manufacturing technology orders of $166.19 million, increasing 27.3% over the November result ($130.54 million) but down -9.7% from the December 2011 result, $184.03 million. The region’s year-end total was $1.814 billion, just 1.0% above the 2011 outcome, $1.8 billion.

In the Central region, the December manufacturing technology orders rose 14.6% to $125.05 million, from $109.10 million in November. The recent month fell short by -1.2% from the December 2011 total, $126.6 million.

The Central U.S. region’s 12-month total for new orders was of $1,586.85 million during 2012, up 4.7% over the 2011 result, $1.515 million.

Finally, the Western region posted new orders of $56.06 million during December, up 8.6% from the November total, $51.62 million, and also up 6.8% versus the December 2011 total, $52.48 million.

In the West, the 12-month total of new orders amounted to $679.56 million, 6.9% greater than the 2011 total, $635,41 million.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.