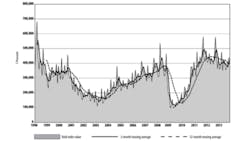

U.S. manufacturers and machine shops ordered $437.79 million worth of new machine tools and related technology during November, rising 0.6% from October to November. The new result represents a 20.7% improvement over the November 2012 result, and it brings the year-to-date (January-November) total to $4,399.22 million, down 7.7% from the comparable result for the first 11 months of 2012.

The data is contained in the monthly USMTO report is compiled by AMT – the Association for Manufacturing Technology and based on actual data for metal cutting equipment and metal forming and fabricating equipment, as reported by participating companies.

The USMTO data covers nationwide results as well as activity in six geographic regions.

“With a strong upswing in automotive sales, the PMI (Purchasing Managers’ Index) at 55 for the month of December, and manufacturing employment continuing to climb, there is no question that the industry headed to the end of 2013 on a very strong note,” stated Douglas K. Woods, AMT president. “It’s also noteworthy that from 2010-2012, November had always been a downturn month for manufacturing technology orders. To see month-over-month and year-over-year increases in orders for November 2013 is yet another sign that manufacturing continues its position of economic strength.”

The final report for 2013 will be released in February.

Regional Results Vary Widely

The USMTO report covers machine tool to orders in six regional markets. However, due to changes in survey participants, year-on-year data for Metal Forming and Fabricating equipment orders is not an accurate reflection of the overall data, AMT explained. Although the overall data has been adjusted to reflect the change, some of the regional reports do not reflect the total of orders in the most recent month.

In the Northeast region, manufacturers’ new machine orders rose just 0.2% from October to November, totaling $71.54 million for the month. That represents 3.8% increase over the November 2012 total, and brings the region’s 11-month total to $732 million, a 3.8% improvement compared to January-November 2012.

The Southeast region had metal cutting equipment orders valued at $35.8 million for November, down 8.7% from October, but up 8.4% from November 2012.

For 2013 cumulative, the region’s total is now $400.91 million, a decline of 17.4% over the year-earlier cumulative total.

In the North Central-East region, total orders rose 21.8% from October, to $126.60 million for November. That figure improved on the November 2012 total by 35.1%, but the year-to-date total for 2013 now lags the comparable 2012 figure by 7.3%.

The North Central-West region saw orders for metal cutting equipment fall 11.4% from October, to $75.98 million. That result is 9.8% higher than the November 2012 total, and brings the region’s annual total to $1,137.26 million, a decline of 7.3% compared to 11 months of 2012.

The South Central region had total machine tool orders of $59.61 million, a 3.0% improvement over October, and a 22.6% improvement over November 2012. The year-to-date total for the region is $661.63 million, a drop of -17.8% versus the January-November 2012 total.

Last, the West reported metal cutting machine orders worth $64.82 million, 8.5% less than October, but 25.0% better than November 2012. The 11-month total is $641.79 million, which is 5.2% higher than the comparable figure for 2012.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.