Global Steel Tonnage Up, Despite Tariffs

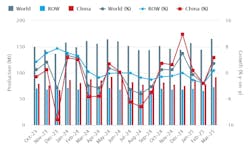

Global raw steel production increased 12.9% from February to March, up to 166.1 million metric tons across the 69 countries tracked by the World Steel Association. The total is 2.9% higher than the March 2024 total, but the year-to-date total of 468.6 million metric tons is barely even (-0.4%) with the volume recorded for January-March 2024.

Steel production worldwide continues to face weak demand, and steelmakers in most industrialized regions continue to restrain any surplus tonnage that may weaken prices – as they have done for the past three years. In nearly every regional and national total reported by World Steel, the results for the first quarter of 2025 are even with or slightly less than the figures reported for Q1 2024.

And although the new data covers the period of the U.S. implementation of 25% tariffs on steel imports, on March 12, the effect is not apparent in the month’s results. The rise in global output is mainly the effect of significantly higher output in China, the world’s major exporter of steel, but the new total is in line with recent years’ rise in that country’s raw-steel production from February to March.

Likewise there is no apparent improvement in U.S. steel output as a consequence of the tariffs.

World Steel reports monthly data for raw steel production regionally and in 69 nations. The data documents carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. Specialty and stainless steel volumes are not included.

Chinese raw steel output increased markedly during the month, up 15.0% from February to 92.8 million metric tons – which also represents a 4.6% increase over the March 2024 tonnage. But the improvement simply draws the total into parity: China’s year-to-date steel output is now even (+0.6%) with the comparable Q1 result for 2024.

In India March steel production hit 13.8 million metric tons, up 8.0% from the February result and 7.0% from March 2024. For the January-March period, Indian steelmakers’ 40.1 million metric tons is 6.8% ahead of last year’s total.

Japanese steelmakers produced 7.2 million metric tons last month, 11.1% better than February and even (+0.2%) with last March’s tonnage. The year-to-date total of 20.4 million metric tons is off the 2024 pace by -4.9%.

U.S. raw steel production rose 10.4% from February to March to 6.7 million metric tons (7.4 million short tons), but that new result is down -1.5% from March 2024, and the January-March result of 19.7 million metric tons (21.7 million short tons) is slightly lower (-0.6%) than last year’s Q1 result.

Russian steelmakers produced 6.2 million metric tons during March, 6.5% more than in February but -3.2% less than in March 2024. Their YTD total is 17.7 million metric tons, -3.8% less than the comparable figure from 2024.

In South Korea, March raw steel production fell -4.0% from February to 5.0 million metric tons. That is also -5.3% lower than March 2024, and the 15.5 million metric tons produced from January to March is -3.6% less than in the first quarter of 2024.

Across the European Union (27 countries), March output was 11.7 million metric tons, about even (0.2%) with March 2024, but the three-month result for 2025 is 32.4 million metric tons, -2.5% less than last year.

Within that result, the German industry produced 3.1 million metric tons, 6.5% ahead of February and -2.8% behind the March 2024 total. The country’s YTD total of 8.5 million metric tons is -12.6% less than 2024.

World Steel reports monthly data for raw steel production regionally and in 69 nations. The data documents carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. Specialty and stainless steel volumes are not included.