Machine Tool Orders Signal Improving Demand

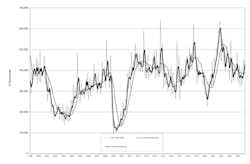

U.S. machine shops and other manufacturers ordered $448.8 million worth of capital equipment during in November, 16.8% more than during October and 12.4% more than during November 2023. The new figure raises the 11-month total for manufacturing technology orders to $4.18 billion, which is -5.7% less than the comparable total for January-November 2023.

The totals are supplied by AMT - the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report, a monthly summary of purchases of metal-cutting machinery and metal-forming and fabricating machinery nationwide, and in six regions. The USMTO report serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

AMT noted that the November results continue the upward trend in order value that first appeared with the September 2024 ($450.6 million) report, and are “nearly 30% above a typical November … the highest order level for any November since 2021.”

“This is further evidence of the lengthened buying cycle for metalworking machinery in recent months,” AMT observed. “As the impetus for capital investment shifts from augmenting capacity to quality and efficiency improvements, the time between an initial quotation and an order being placed has expanded.”

The November results also show positive order activity across each of the six regions tracked by USMTO, all of them marking increases from October, and only the Southeast region falling behind their November 2023 results. However, among the six regions, only the West stands ahead of its January-November 2023 record.

AMT noted that November manufacturing technology orders from contract machine shops – the largest segment of the customer market – were at their highest level since March 2023. “This is a welcome sign for the larger manufacturing sector, as these shops typically receive additional work when OEMs experience capacity constraints,” AMT reported.

By contrast, aerospace manufacturers’ orders fell from decreased their orders from October but are still ahead of their 2024 average, “indicating the effects of the nearly two- month strike of Boeing machinists likely only shifted demand.”