U.S. machine shops and other manufacturers ordered $378.4 million worth of machine tools during May, improving by 7.3% over the monthly total for April, but falling -21.9% behind the May 2018 new-order total. With the latest results, 2019 U.S. manufacturing technology orders are trailing 2018 orders by -13.5% for the comparable January-May period.

The U.S. Manufacturing Technology Orders report is issued monthly by AMT – the Assn. for Manufacturing Technology, tracking new orders for metal cutting and metal forming and fabricating equipment as a leading indicator of industrial activity. The USMTO report is based on data supplied by participating producers and distributors of that equipment, and offers a leading indicator of industrial demand as machine shops and other manufacturers invest to complete planned or anticipated production programs.

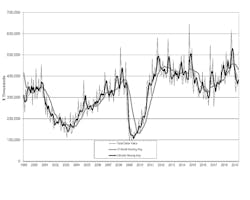

While the index of new orders surged in 2017 and 2018, demand has been considerably weaker since the fourth quarter of last year.

“Manufacturing technology orders will be good but smaller than 2018, and we will see a significant move in the customer mix as large manufacturers shift capital liabilities down the supply chain or into the machine shop sector,” commented AMT’s chief knowledge officer Pat McGibbon.

However, he noted a shift in the most recent quarter. “In the past four months, the share of total orders placed by machine shops increased more than 20%. This is typical of business cycles with disruptions rather than a decline in manufacturing activity,” according to McGibbon.

AMT noted that the recent growth in orders has been uneven: construction and agricultural machinery manufacturing, as well as industrial machinery manufacturing sectors have been strong; medical equipment manufacturing and primary metal manufacturing have been weak. “Orders from the aerospace sector increased just under 10%, and the engine and turbine sector, as well as automotive orders, increased by a third and a quarter, respectively,” AMT reported. “Machine shop orders fell by less than 1%."

In its regional summaries, the USMTO report indicated new orders metal-cutting equipment in the Northeast fell -4.2% from April to $57.22 million in May. That figure is -19.1% behind the region’s May 2018 result, and brings the year-to-date total to $330.9 million, down -7.4% from the January-May result for 2018.

In the Southeast region, total manufacturing technology orders increased 25.8% from April to $60.16 million in May, and that figure nearly even (-0.1%) with the May 2018 regional result. Through five months of 2019, the Southeast region has drawn metal-cutting orders worth $229.24 million, which is a 2.6% increase over 2018.

In the North Central-East region, total new orders for manufacturing technology rose to $91.61 million in May, up 14.6% from April and down -28.1% from May 2018. For the January-May 2019 period, the region has posted manufacturing technology orders of $419.58 million, down -17.1% from 2018.

In the North Central-West region, new orders for manufacturing technology totaled $67.55 million for May, down -3.5% from April and down -26.7% from May 2018. For the year-to-date, North Central-West regional orders for metal-cutting equipment totaled $336.79 million, down -15.2% versus last year.

The South Central region posted new orders for metal-cutting equipment worth $33.4 million, a rise of 12.5% from April but a drop of -34.4% from May 2018. The YTD regional total for metal-cutting equipment is $159.95 million, a decline of -28.6% from last year.

In the West, new orders for metal-cutting equipment rose 8.9% from April to $65.62 million. That figure is down -19.6% from May 2018, and it brings the YTD regional total to $327.71 million, a decline of -12.7% from January-May 2018.

U.S. machine shops and other manufacturers ordered $378.4 million worth of machine tools during May, improving by 7.3% over the monthly total for April, but falling -21.9% behind the May 2018 new-order total. With the latest results, 2019 U.S. manufacturing technology orders are trailing 2018 orders by -13.5% for the comparable January-May period.

The U.S. Manufacturing Technology Orders report is issued monthly by AMT – the Assn. for Manufacturing Technology, tracking new orders for metal cutting and metal forming and fabricating equipment as a leading indicator of industrial activity. The USMTO report is based on data supplied by participating producers and distributors of that equipment, and offers a leading indicator of industrial demand as machine shops and other manufacturers invest to complete planned or anticipated production programs.

While the index of new orders surged in 2017 and 2018, demand has been considerably weaker since the fourth quarter of last year.

“Manufacturing technology orders will be good but smaller than 2018, and we will see a significant move in the customer mix as large manufacturers shift capital liabilities down the supply chain or into the machine shop sector,” commented AMT’s chief knowledge officer Pat McGibbon.

However, he noted a shift in the most recent quarter. “In the past four months, the share of total orders placed by machine shops increased more than 20%. This is typical of business cycles with disruptions rather than a decline in manufacturing activity,” according to McGibbon.

AMT noted that the recent growth in orders has been uneven: construction and agricultural machinery manufacturing, as well as industrial machinery manufacturing sectors have been strong; medical equipment manufacturing and primary metal manufacturing have been weak. “Orders from the aerospace sector increased just under 10%, and the engine and turbine sector, as well as automotive orders, increased by a third and a quarter, respectively,” AMT reported. “Machine shop orders fell by less than 1%."

In its regional summaries, the USMTO report indicated new orders metal-cutting equipment in the Northeast fell -4.2% from April to $57.22 million in May. That figure is -19.1% behind the region’s May 2018 result, and brings the year-to-date total to $330.9 million, down -7.4% from the January-May result for 2018.

In the Southeast region, total manufacturing technology orders increased 25.8% from April to $60.16 million in May, and that figure nearly even (-0.1%) with the May 2018 regional result. Through five months of 2019, the Southeast region has drawn metal-cutting orders worth $229.24 million, which is a 2.6% increase over 2018.

In the North Central-East region, total new orders for manufacturing technology rose to $91.61 million in May, up 14.6% from April and down -28.1% from May 2018. For the January-May 2019 period, the region has posted manufacturing technology orders of $419.58 million, down -17.1% from 2018.

In the North Central-West region, new orders for manufacturing technology totaled $67.55 million for May, down -3.5% from April and down -26.7% from May 2018. For the year-to-date, North Central-West regional orders for metal-cutting equipment totaled $336.79 million, down -15.2% versus last year.

The South Central region posted new orders for metal-cutting equipment worth $33.4 million, a rise of 12.5% from April but a drop of -34.4% from May 2018. The YTD regional total for metal-cutting equipment is $159.95 million, a decline of -28.6% from last year.

In the West, new orders for metal-cutting equipment rose 8.9% from April to $65.62 million. That figure is down -19.6% from May 2018, and it brings the YTD regional total to $327.71 million, a decline of -12.7% from January-May 2018.