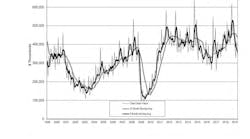

U.S. machine shops and other manufacturers’ capital investments in machine tools totaled $344.6 million during April, down -16.5% from March and -17.6% from April 2018, continuing what AMT – the Assn. for Manufacturing Technology called a "general downward trend in orders." After an extended run of rising order totals in 2017 and 2018, the U.S. Manufacturing Technology Orders report has detailed declining totals for new orders in five of the seven months since IMTS 2018, last September.

Through the first four months of 2019, U.S. new orders for machine tools totaled $1.48 billion, -11.6% versus the January-April 2018 period.

AMT issues the monthly U.S. Manufacturing Technology Orders report, which records new orders for metal cutting and metal forming and fabricating equipment as a leading indicator of industrial activity. The USMTO report is based on data supplied by participating producers and distributors of metal-cutting and metal-forming and -fabricating equipment, and offers a leading indicator of industrial demand as machine shops and other manufacturers invest to complete planned or anticipated production programs.

“Competition in the manufacturing technology market for 'standard' products continues to grow in intensity relative to the positive growth seen in engineered solutions,” commented AMT president Douglas K. Woods. “Our members are telling us that the ready availability of products has eliminated the urgency for customers to invest in capital equipment now, while trade issues raise grave concerns about the continued strength of the manufacturing sector in the near future.”

AMT noted that despite the broader trend, some manufacturing sector exhibited some growth during April: the aerospace sector grew by single digits, and the auto industry grew by more than 30% over March levels.

In addition to the nationwide USMTO results, nearly all of the report’s six regional summaries reflect the current slowing pace of new order activity. In the Northeast, total orders for manufacturing technology fell -27.2% from March to $62.78 million in April, which is -13.7% below the April 2018 regional total. For the January-April 2019 period the Northeast region has ordered $273.19 million worth of metal-cutting equipment, a -4.7% year-to-date decline.

In the Southeast, total manufacturing technology orders declined -25.8% from March to $44.54 million. Compared to April 2018, regional metal-cutting equipment orders down -1.4% to $38.74 million, and the year-to-date order total stands at $185.87 million – a 13.0% rise.

In the North Central-East region, total manufacturing technology orders fell -20.4% from March to $80.66 million for April. Through four months, the region has recorded total manufacturing technology orders of $330.17 million, a year-to-date decline of -12.8%.

For the North Central-West region, new orders for metal-cutting equipment fell only -0.4% from March to $68.4 million during April. That figure is a -12.1% decline from the April 2018 result, and for the year-to-date the region has posted new orders totaling $270.53 million, down -11.8% from January-April 2018.

In the South Central region, new orders for metal-cutting equipment fell -10.4% from March to $31.3 million for April. That signifies a 3.5% increase from April 2018, but for the year-to-date the region has recorded metal-cutting equipment orders totaling $128.16 million, a drop of -26.1% from January-April 2018.

Finally, in the West region, the latest monthly total for metal-cutting equipment orders totaled $54.95 million, a -13.8% drop from the previous month and a -18.1% drop from April 2018. For the January-April period, regional orders for metal-cutting equipment have totaled $252.17 million, a drop of -14.1% versus the four-month total for 2018.