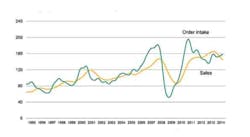

Germany’s machine tool builders saw new orders decline by 8% compared to the third quarter of 2013, and as a consequence the year-to-date order volume is just 1% higher than the record for the comparable first nine months of last year. The results are contained in the latest report from VDW, the German Machine Tool Builders' Association, which represents one of the most important industrial sectors in that nation’s economy, as well as a critical constituency in the global manufacturing technology sector.

The third-quarter results confirm the tentative nature of industrial demand in the European Union. In recent years, German machine tool manufacturers have performed comparatively better than those of other countries in the region, though recently CECIMO (the federation of European machine tool builders’ associations) reconfirmed its concern over the declining rate of new capital investment by Europe’s manufacturing businesses.

VDW reported its members’ domestic orders were down 9% versus Q3 2013, while their export orders are 7% lower compared to the earlier period .

Through the first three quarters of 2014, German machine tool builders domestic orders are up 8%, year over year, while overseas orders fell 3%.

“Order bookings have not come up to expectations so far in 2014,” observed VDW executive director Dr. Wilfried Schäfer. “Most recently, following a strong first half of the year, domestic orders took a downturn in the year’s third quarter.

Echoing the Cecimo position, Schäfer said: “Growing uncertainty on how the global economy will develop is downgrading the propensity to invest among German customers, a situation exacerbated by the crisis in the Ukraine, the dormant state of business with Russia, and the cautious development in China.”

This weakening demand is evident in order levels from abroad. VDW said its seasonal adjustments show a smooth trend upward, strong increases in demand forecast earlier this year has not materialized. That outcome is evident in the month-to-month instability of order levels (though, unlike some trade groups, VDW has not released the actual data for its report.)

There are some notable exceptions. VDW said its members’ demand from EU nations have been rising in recent months, and increased by 12% during Q3. Eastern European nations in particular, specifically Poland, Hungary, and Czech Republic delivered strong growth rates, VDW allowed.

As for the types of machines that are in demand, VDW said forming technology appears to be especially weak after a weak month in September. Demand in this segment is highly cyclical, the source offered, driven by automotive industry activity, and forming technology accounts for 25-30% of total production in the machine tool sector.

VDW’s members revenues (turnover) are down 6% year over year. “Against this background, and given the weak trend in order bookings, we do have to downsize our production output forecast for 2014 of 3% growth, a figure that in the year’s first half was still a realistic one,” said Schäfer.

Now, VDW is predicting total production volume will be flat for 2014, meaning no change from the 2013 order volume estimated at $17.5 billion, or €14.6 billion.