First quarter reports show the machine tool builders in Germany and Italy —Europe’s two largest-producing nations — are regaining some stability in their home markets. Domestic sales remain significant bases for the builders, which have relied heavily on exports for revenues in the past two years.

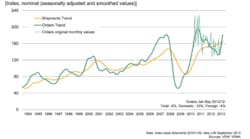

VDW, the German Machine Tool Builders' Association, reported its members Q1 2014 domestic new orders rose 20% over the total for the same period of 2013. New orders for exports rose 5% in the same comparison.

German machine tool manufacturers produced capital goods and services worth about €14.5 billion in 2013, a 2% annual increase. It ranks among the largest manufacturing sectors in the country’s economy.

"The domestic market is a major source of demand for the machine tool sector right now," according to VDW executive director Dr. Wilfried Schäfer.

The group indicated that new orders began to rise at the end of 2012, and that continuing trend “confirms just how optimistic German clients are at the moment, and how the domestic reluctance to invest is now well and truly over,” Schäfer said. “This is also reflected by the sentiment levels in industry which have risen again recently.”

VDW detailed that among its members customers, orders for new machine tools have risen by 14%, with especially strong demand for turning and grinding machines. Forming equipment orders were up 4%.

“No clear increase in demand as yet been noted from foreign customers,” Schäfer said. “Orders from the euro zone in particular were down by 10%.

"We are pinning our hopes on Asia and America," explained Schäfer. The 9% increase seen in orders from outside the euro zone in the first quarter, by contrast, was much stronger.

"The first quarter has given the green light to increased production in the current year," he continued, though he cautioned that all VDW’s forecasts are based no negative impact from international developments, specifically the risk of escalating hostility involving Russia, the third-largest foreign market for the German machine tool industry.

Tax Laws Changes Help, More Help Needed

In the Italian machine tool industry, first-quarter 2014 orders increased 15.2% compared with the January-March 2013 period. It noted the result is due to both foreign and domestic demand. The results were reported by the research arm of UCIMU-Sistemi per Produrre, the trade association for Italian manufacturers of machine tools and automation devices.

“The quarterly survey … shows a general recovery in the demand for Italian machine tools, with the increase appearing more evident on the domestic market," observed Luigi Galdabini, president of UCIMU.

The group explained that orders from the Italian market rose 79.3% versus the first quarter of 2013. Demand for exports showed a 5.7% increase, “confirming the positive trend recorded starting from the last quarter of 2013,” the group reported.

Noting that foreign demand had sustained Italian machine tool builders over the past two years, Galdabini said the domestic market seems to be awakening. “This is a great signal that must, however, be interpreted taking into account that the increase appears so marked because it is set against such a negative period, which we now hope is finally behind us," he detailed.

He noted that changes in Italian tax law have eased the cost of borrowing for capital investment, a change that UCIMU has lobbied for extensively in recent years. However, he said the changes in the law would not be enough to ensure the recovery of the Italian market, “which has for too long suspended the acquisition and the replacement of high technological performance machinery.”

Galdabini stated that Italian industry needs further reduction in the tax liabilities associated with equipment depreciation

“As far as the foreign markets are concerned,” he continued, “considering the strong predisposition for export of our companies, mainly small- to medium-sized (enterprises), and therefore with limited resources to allocate to marketing, it would be important to increase the activities for the promotion of the Made in Italy, which thanks to collaborations among sector associations and the ICE Agency can help, amongst other things, to present the industrial sectors in which Italy excels in a compact and organic way”.