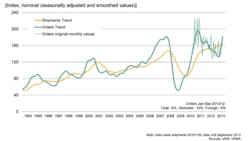

The German Machine Tool Builders’ Association (VDW) reported third quarter 2013 new orders increased 9%, year-on-year, guided by strong demand from the domestic market. Orders from Germany’s industrial sector rose 12% versus the result from the third quarter of 2012, and orders for exports increased 6% over last year’s comparable figure.

Germany’s machine tool industry is one of the largest industrial segments of that nation’s economy, and the results cover demand for both metal-cutting and forming machine tools.

The new figure is notable for reversing the weak demand that has plagued the German industry during 2013: at midyear, VDW reported thatJanuary-to-June orders had declined 1% year-on-year, with domestic orders down 6% and overseas orders increasing 1%.

“Demand for machine tools has achieved the long-awaited turnaround,” according to Dr. Wilfried Schäfer, executive director of VDW. He noted in particular that the months of August and September saw double-digit growth in both domestic and export orders, and in both the metal-cutting and forming machine tool segments.

Schäfer observed that this trend reflects a boost in orders placed during EMO Hannover 2013, the global machine tool trade fair held in September.

In spite of the positive turn, the Q3 report indicated that German machine builders’ January-September new orders have dropped 6% overall, year-on-year. VDW reported domestic orders fell by 10%, and orders from foreign buyers fell by 4%.

VDW reported that a substantial element of the recent improvement is driven by orders for forming technology. That sector showed a 61% in new orders during the third quarter, and a 27% increase in orders for the year to date.

China has been the largest export market for German machine builders, but VDW noted there are signs of weakening there. Demand from China fell significantly in the year’s first half, and Schäfer said reform efforts in Chinese economic planning make the current situation there too difficult to evaluate.

“The new Chinese government is rigorously reviewing the entire investment program of the ongoing five-year plan,” he explained. Until this process is completed, no substantial recovery in demand should be expected, he said.

Shäffer said Western European demand has been stronger than anticipated for German machine builders. New orders from Central and South America also showed double-figure increases, and South Korea and other Southeast Asian countries also showed improvement.

“In view of the improving order situation, the VDW’s current production output forecast for the ongoing year is not at risk,” Wilfried Schäfer concluded.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.