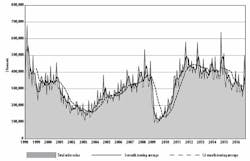

U.S. manufacturers ordered $335.48 million worth of machine tools and related manufacturing technology during October, a drop of 32.9% from the September result, and yet still ahead of the October 2015 total by 0.2%. The month-to-month decline was expected by AMT – the Association for Manufacturing Technology, which released the totals in its monthly U.S. Manufacturing Technology Orders report, because the September report included results of machine tool sales during the International Manufacturing Technology Show.

The USMTO report summarizes actual totals for machine tool sales, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment. AMT describes USMTO data as a reliable leading economic indicator, as manufacturing companies invest in capital equipment to increase capacity and improve productivity.

The biennial IMTS event typically spikes machine-tool orders during the respective month. With the October results, the prevailing demand factors have resumed their prevalence. At $3.12 billion, the year-to-date USMTO result trails the 10-month total for 2015 by 5.6%.

According to AMT, new orders are slowly recovering from the lows that have prevailed for much of the current year, and it pointed to growth trends in housing, appliances, automotive, and electronics markets as signs of an emerging recovery.

“It’s certainly welcome to see signs of recovery for manufacturing overall, but marked improvement for manufacturing technology orders is not forecast until the second quarter of 2017,” stated AMT president Douglas K. Woods. “Unless manufacturers feel pressed on capacity, they aren’t likely to make substantial capital investments in machinery and equipment. Those signs of gradual improvement and increased utilization rates are emerging, albeit slowly.”

The USMTO’s regional summaries exhibited declines of varying degrees, in line with the nationwide figures. In the Northeast region during October, manufacturing technology new orders totaled $54.48 million falling 41.4% from September, and 2.0% from October 2015. The 10-month total for new orders in the region is $623.6 million, down 4.0% from the comparable total for 2015.

In the Southeast region, October new orders for metal-cutting equipment fell 43.5% from September but rose 21.7% from October 2015, finishing the month at $37.43 million. The region’s total year-to-date orders stand at $464.79 million, which is 26.7% higher than last year’s January-October total.

The North Central-East region’s manufacturing technology new orders totaled $105.13 million, which is 14.7% lower than September and 7.5% lower than October 2015. For the January-October period, the region’s total manufacturing technology new orders stand at $823.77 million, down 16.0% versus the region’s 2015 10-month total.

The North Central-West region had October metal-cutting equipment new orders totaling $59.49 million, which is 26.5% lower than during September but 23.9% higher than during October 2015. Year-to-date, the region’s total manufacturing technology new orders are now reported to be $593.96 million, 7.3% lower than last year’s 10-month total.

The South Central region’s metal-cutting equipment new orders fell to $15.6 million, down 30.0% from September and down 19.9% compared to October 2015. The 10-month total for manufacturing technology equipment in the region is $189.01 million, a 26.7% decline from 2015’s comparable result.

In the West region, metal-cutting equipment new orders totaled $53.01 million, a decline of 44.8% from September and of 7.0% from October 2015. The West’s year-to-date manufacturing technology new orders are reported to be $548.94 million, up 1.4% versus January-October 2015.