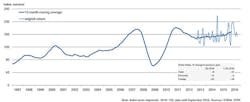

Third-quarter 2016 new orders for machine tools weakened in Germany and Italy, two of the largest contributors to the European machine-tool market, and two of the largest machine-tool exporting industries in the world. While the Europe’s machine-tool manufacturers have regained some growth momentum in the past year (after a slow recovery from the 2009 recession) the latest trends show that weak global industrial demand still having some effect.

The results are found in the 3Q activity summaries issued by VDW, the German Machine Tool Builders Assn., and UCIMU, the Italian trade group representing manufacturers of machines tools, automation systems, and auxiliary products. Both VDW and UCIMU are members of CECIMO, the European Union-wide federation of machine-tool trade associations; earlier this year, CECIMO presented an encouraging outlook for EU machine tool output and an even more optimistic view of the trend for machine tool exports, in spite of global industrial weakness.

For the third quarter of 2016, the German machine tool industry’s new orders rose by 8% compared to Q3 2015. Domestic (i.e., German) orders were down by 14%, though demand from abroad increased by 22%.

During January-September 2016, new orders were up by 11% compared to the first nine months of 2015. For the year-to-date, VDW reported domestic orders have shown a year-on-year improvement 2%, while demand from abroad is up by 16%.

“In the year’s third quarter, our sector has been able to build on the encouraging business trends of 2016’s first half,” according to Dr. Wilfried Schäfer, executive director of VDW. “The good order situation is here being crucially boosted by demand from abroad. This applies for the Eurozone and to an even greater extent for the non-Eurozone.”

VDW emphasized that southern European markets (Italy, Spain, France) are particularly strong with new machine-tool orders. Outside from the U.S. have shown particular strength, especially because of rising volume from the automotive industry.

“In contrast to the preceding months, developments in the third quarter of 2016 were not dominated by large orders,” Schäfer noted. “Rather, we’re seeing a balanced picture over the various product categories involved, which are proving very successful on the global market.”

For Italian machine-tool builders, 3Q new orders decreased 5.8% versus the third-quarter of 2015, and for the second consecutive quarter the decrease was due to falling demand from foreign buyers. Specifically, out-of-country orders fell 6.8% compared to July-September 2015, which UCIMU identified as an effect of continuing weakness in international demand. It went on to note that during the first seven months of 2016 (latest available data) exports of Italian machine tools have decreased by 4.7% versus 2015.

However, sales increases are noted for Germany (+9.6%), France (+37.4%), and Poland (+5.8%), while sales to the U.S. (-7.9%) and China (-16.8%) have declined through the course of the current year.

The Italian market continues to support the domestic machine-tool sector. New orders during 3Q increased 11% versus 3Q 2015.

“Of course, we are not pleased with the slight slowdown shown by the index,” commented Massimo Carboniero, president of UCIMU; “decreases were reported in some important foreign markets, such as the United States, engaged in the final rush of elections, whereas other markets slowed down, for example China, and others had difficulties, for example Russia. However, we don't worry as our history teaches us that Italian manufacturers are really capable of re-orienting the offering towards the liveliest areas,” he said, meaning the Italian market, which is actively replacing obsolete capacity.