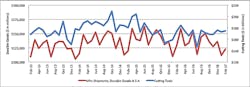

U.S. machine shops and other manufacturers consumed $174.98 million worth of cutting tools during February, indicating a steady rise in manufacturing activity. Cutting tool consumption is a reliable indicator of trends in U.S. manufacturing activity, according to the sponsors of the monthly Cutting Tool Market Report, "as it is a true measure of actual production levels."

The February CTMR indicates a 1.1% increase in consumption from January’s $173.05 million total, and a 0.6% year-on-year rise over the $173.88 million total for February 2016. February rerpresents the third-consecutive increase in U.S. cutting tool consumption, following more than a year of lackluster demand in the index.

Through two months of activity for 2017, U.S. cutting tool consumption has risen to $348.02 million, up 4.5% versus the comparable figure for 2016.

The CTMR is issued each month by the U.S. Cutting Tool Institute (USCTI) and AMT – the Association for Manufacturing Technology. The data summarizes cutting-tool sales based on actual dollar figures reported by participating companies, who represent the majority of the U.S. market for cutting tools.

The report’s sponsors cited Scott Hazelton, managing director of Economics & Country Risk at IHS Markit that, “The economy is enjoying improved business and consumer confidence, resulting in strong momentum in employment growth and single family housing as well as a rebound in nondefense capital spending, including the important energy sector.”

IHS forecasts that consumption of cutting tools will continue to over the course of 2017, and continue to grow in 2018 “as tax reform and infrastructure investment enhance the investment outlook.”

“There is a feeling of optimism in the air that is backed up by the positive growth the cutting tool market data shows after the first two months of the year,” according to Steve Stokey, president of USCTI.

“Manufacturing continues to be a hot topic and continues to have a seat at the table in the new Trump administration,” he continued. “The strong dollar will continue to challenge our ability to export but with the U.S. automotive and aerospace markets remaining steady, it should provide a firm foundation for growth as the other industrial sectors rebound from a weak 2016. This should bode well for cutting tool manufacturers.”