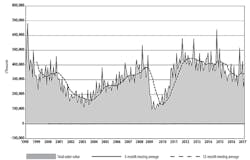

U.S. manufacturers ordered $300.51 million worth of new machine tools during February 2017, a 19.6% increase from January, and a 1.7% rise over the February 2016 total. The results — which are drawn from the latest U.S. Manufacturing Technology Orders report issued by the Association for Manufacturing Technology — are encouraging after disappointing order totals during January, and add evidence to the message of improving demand in the U.S. manufacturing sector.

“We anticipated an increase in orders after a soft January, but we are surprised by the strength of the February numbers,” commented AMT president Douglas K. Woods. “What’s even more encouraging is the pickup wasn’t a spike related to any specific industry or region, but rather was broad-based – from Northeast to West as well as everything from aerospace to consumer products.”

The USMTO is a monthly report of new orders of machine tools in the U.S. It summarizes actual totals for machine tool sales, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

AMT describes USMTO data as a reliable leading indicator of current activity in the industrial economy, as manufacturing companies invest in capital equipment to increase capacity and improve productivity. With some intermittent positive periods, USMTO has exhibited generally weak demand for more than two years.

AMT has predicted a broad revival in manufacturing demand to occur during the first half of 2017. In its February release, the association cited the positive indicators in a series of sectors, including appliances medical devices; and off-road and highway equipment.

“This (February) activity reinforces our projections for a full recovery in manufacturing technology orders by the end of the second quarter,” according to Woods.

The rising demand is evident in the results for each of regions presented in the USMTO. In the Northeast region, new orders for metal-cutting machinery rose to $64.85 million, up 40.7% from January and up 48.6% from February 2016. The year-to-date regional total for metal-cutting machinery new orders is $110.94 million, 10.9% higher than the comparable total for 2016.

Total manufacturing technology new orders for the Southeast region rose to $29.99 million during February, an increase of 8.9% from January but a 32.7% drop from the February 2016 result.

In the North Central-East region, total manufacturing technology new orders were $77.71 million during February, a 21.9% increase from January and a 9.0% decline from the February 2016 result. For the year-to-date, the region’s new orders are down 6.4% versus 2016.

New manufacturing technology orders for North Central-East region rose to $47.76 million during February, up 11.4% from January but down 5.2% from February 2016.

In the Southwest, new orders for metal-cutting machinery increased to $27.39 million during February, up 29.3% from January and up 38.8% from February 2016. For the January-February period, Southwest regional new orders totaled $48.59 million, which is 44.9% higher than last year’s two-month total.

Finally, the West region reported new orders for metal-cutting machinery totaling $49.83 million during February, up 2.5% from January and up 2.9% from January 2016. The year-to-date total fell to $98.46 million, 2.2% lower than the two-month total for 2016.