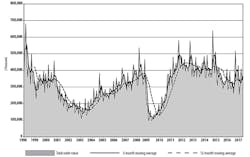

U.S. manufacturers’ and machine shops’ new orders for machine tools rose to $351.85 million in May, according to AMT – the Association for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report. The totals represent a 3.1% increase over the comparable April figure, and a 21.8% rise over the May 2016 total. It is the third month-over-month increase in new orders during 2017

For the year to-date, U.S. manufacturers’ new orders are valued at $1.67 billion, up 7.4% over the January-May 2016 total.

AMT’s monthly USMTO report is an account of actual totals for machine tool sales, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

The USMTO is an indicator of manufacturers’ future planning, in contrast to current activities (which are covered by the monthly Cutting Tool Market Report.)

“As we’ve now seen year-over-year growth for four consecutive months, and with that growth acceleration, all signs indicate a continued trend of strength for the manufacturing technology industry,” stated AMT vice president – Strategic Analytics Pat McGibbon.

According to AMT, automotive suppliers placed “some significant orders” during May. That activity paired with ongoing investments by machine shops, indicating a need for more production capacity.

AMT also noted that rising manufacturing technology order volumes complement other positive economic indicators, such as increases in industrial production, export volumes, the industrial expansion evident in the ISM’s Purchasing Managers Index, and consumer confidence indexes.

“With activity growing in many geographic regions and continued strengthening in key industries like job shops, autos and aerospace, all of this suggests the market will continue to grow and stay strong for the coming months,” added McGibbon.

In the Northeast, manufacturers ordered $58.06 million worth of metal-cutting machinery during May, 25.6% more than during April and 20.1% more than during May 2016. The region’s year-to-date manufacturing technology new orders now total $287.76 million, which is down 4.7% compared to the January-May 2016 total.

In the Southeast region, new orders fell 5.4% from April to $36.33 million in May, though that total is up 10.0% from May 2016. For January through May, the Southeast’s new orders for metal-cutting equipment total $187.95 million, just 2.7% higher than last year’s five-month result.

The North Central-East region had new orders for metal-cutting equipment totaling $77.81 million during May, down 4.7% from April but up 19.4% from May 2016. The five-month total for metal-cutting equipment in the region is $382.26 million, 2.1% more than the 2016 result.

In the North Central-West, new orders for metal-cutting equipment during May rose 67.0% from April to $81.63 million. That result is 31.5% higher than the May 2016 total, and yet the year-to-date result is essentially unchanged from January-May 2016 at $282.59 million.

The South Central region’s new orders for metal-cutting equipment fell to $30.22 million, down 27.6% from April but up 76.6% from May 2016. For the January-May period, South Central regional manufacturers have ordered $163.38 million worth of manufacturing technology, a 64.5% increase over the comparable total for five months of 2016.

Lastly, in the West region, new orders for metal-cutting equipment declined 26.7% from April to $56.35 million during May. The figure is 7.0% higher than the May 2016 result, and the region’s year-to-date total for manufacturing technology increased to $316.05 million, up 16.7% from January-May 2016.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.