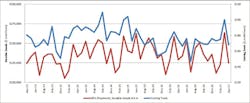

Machine shops and other domestic manufacturers consumed $168.03 million worth of cutting tools during April, 16% less than the comparable total for March and 3.6% less than the April 2016 figure. It was the first decline in cutting-tool consumption since November 2016, and while the latest results suggest a break in the U.S. manufacturing recovery evident through the first quarter of this year, the four-month total (January-April 2017) total for cutting tool consumption is $716.11 million, up 3.5% compared to the same period of last year.

These figures are drawn from the latest Cutting Tool Market Report, issued monthly by the U.S. Cutting Tool Institute and AMT – the Association for Manufacturing Technology. Cutting tool consumption is offered as a leading indicator of U.S. manufacturing activity, as cutting tools relate directly to actual production levels.

The CTMR includes real numbers based on the totals reported by participating companies participating, and represents the majority of the U.S. market for cutting tools. The index contrasts with the monthly U.S. Manufacturing Technology Orders report, also issued by AMT, which tracks demand for machine tools as indicator of manufacturing confidence.

“Once you get past the initial shock of seeing a large downturn in April and look deeper into the numbers, you begin to see that April had four less working days than March,” stated USCTI president Steve Stokey.

“The average sales per working day were actually up in April,” Stokey noted. “This is good news for the industry as it continues to outperform 2016.”

“We have seen the cutting tool market recuperate and gain strength since IMTS 2016, with the exception of one or two months,” commented Chris Kaiser, CEO of cutting-tool manufacturer BIG Kaiser. “If the activity in (the) oil-and-gas, mining, construction, and agricultural industries continues to improve, I think we could see a continued year-over-year increase in cutting tool consumption.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.