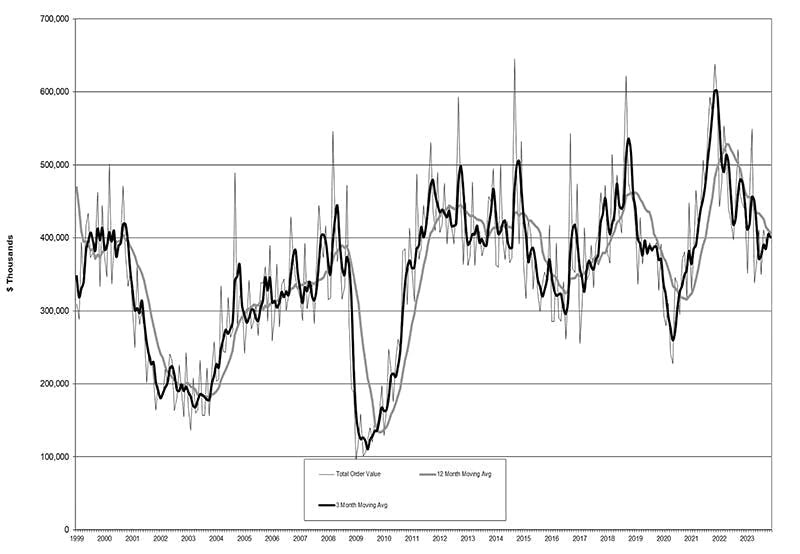

U.S. manufacturers’ new orders for machine tools continued to faded further during November, down -2.0% from October to $399.8 million, a total that is -10.3% lower than the year-ago result. Despite some positive indicators within the overall result, as noted by AMT – the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report, the eleven-month total for new orders comes in at $4.45 billion, which is -13.3% lower than the January-November total for 2022.

AMT’s monthly USMTO program reports new orders of machine tools as an indicator of future manufacturing activity, as machining operations prepare to undertake new production programs. The monthly update tracks orders for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

The largest segment of the market for machine tools is contract machine shops, and in November 2023 those customers’ new orders fell by almost -16% from October, according to AMT.

The decline was nearly balanced by increases from other manufacturing sectors, AMT noted: investments by aerospace manufacturers rose 60% above the 2023 monthly average, it reported.

Improved demand from aerospace as well as automotive manufacturers resulted in some encouraging indications among the USMTO’s regional summaries for November 2023. New orders for metal-cutting machinery increased month-over-month in the Northeast (+14.7%), Southeast (+14.4%), and North Central-West (+7.0%) regions.

Other regions reported month-to-month decreases in demand, and although the Southeast region showed a solid +37.7% year-over-year improvement in new orders, each of the six regions is trailing its 2022 year-to-date order volume through 11 months of activity.