No Momentum for Cutting Tool Demand

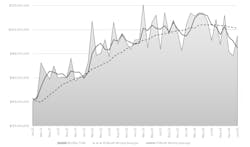

U.S. machine shops and other manufacturing businesses ordered $199.9 million worth of cutting tools during January 2025, a 9.2% rise from the cutting-tool order volume for the previous month. The monthly Cutting Tool Market Report also revealed that the January result fell -4.1% below the order total for January 2024.

The CTMR is compiled jointly by USCTI and AMT - the Assn. for Manufacturing Technology as a monthly summary of shipments by companies who comprise the majority of the U.S. market for cutting tools. Because cutting tools are significant consumable purchases for machine shops and other manufacturers, shipments of cutting tools are a reliable index to real-time manufacturing activity.

“January was quite soft for most tooling companies, even more so than normal,” observed AMT Cutting Tool Product Group president Jack Burley. “New investments are on hold, and most shops are only buying what they need to keep spindles turning.”

Economist Eli Lustgarten, president at ESL Consultants, confirmed as much. “Demand continues to suffer from economic uncertainty both here and abroad as well as from the changing political environment, especially with rising tariffs and the impact on supply chains and costs,” Lustgarten offered. “Most major industrial end markets have become cautious: Heavy manufacturing sectors, including farm, construction, and mining equipment manufacturers, are undergoing substantial inventory liquidation in the first half of 2025.”

He continued: “Signs point to a sluggish, if not volatile, first half of 2025. If political conditions and tariffs stabilize, end-market demand may begin to improve in the second half of the year and into 2026 as production increases and inventory liquidation ends.”

According to Burley, “Until the political conditions settle and the uncertainty they create for manufacturing is resolved, I expect to see very little improvement in consumption, especially for small businesses. There are different opinions on the speed at which we can bring more manufacturing back to the United States, so we can only wait and see how companies respond.”