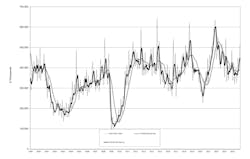

Machine shops and other U.S. manufacturers ordered $513.8 million worth of capital equipment for metal cutting, forming, and fabricating during December 2024, a +15.0% rise from November, and +5.3% more than the previous December’s order total. According to AMT - the Assn. for Manufacturing Technology, the December result represented the highest monthly order total for manufacturing technology orders since March 2023.

AMT reported the results in its latest U.S. Manufacturing Technology Orders report, a monthly summary of capital equipment purchases nationwide, and in six regions. The USMTO report serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

Despite the improvement in December, the total value for 2024 new orders was $4.7 billion – which represents a -3.8% decrease in order values from 2023. The USMTO report has not recorded an annual increase in orders for three consecutive years, since 2021.

But AMT determined that the December order total offered evidence of continued rising demand for manufacturing technology, in particular during the September-December period. Nearly 40% of all 2024 orders were placed during Q4, according to AMT. And it reported that, despite weak demand to start the year, 2024 orders were 9.7% above the annual average for the previous 25 years.

The weakness in USMTO activity during much of the past year may be attributable to low demand from “contract machine shops,” the so-called job shops that are the largest cohort of the industry. Their order total was down -3.7% year over year, nearly even with overall orders. Also reducing their manufacturing technology orders were the automotive manufacturers, from whom demand fell significantly last year as vehicle demand declined.

But, more positively, job shop demand improved during the last quarter of 2024, outperforming the market overall. And bookings from the aerospace segment rose markedly, reaching a three-year high in December 2024.

According to AMT, the late-year demand improvement should be sustained as 2025 proceeds, with January results showing “elevated” quotation activity.