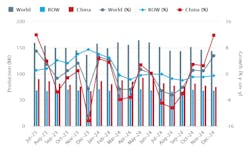

Global steel production topped 1.8 billion metric tons during 2024, about 10 million metric tons or -0.9% less than during 2023. With a total output of 1.84 billion tons produced across 71 countries, as reported by the World Steel Association, it represents the third consecutive year of narrow declines in output for raw steel – the critical commodity for various industrial and construction markets.

The global trend has been shaped on one hand by inflation, which has strained both industrial and construction demand for steel over the past three years, at times made more acute by supply-chain disruptions and regional conflicts.

World Steel reports the monthly totals for carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. Specialty and stainless steel volumes are not included.

In a recent forecast, World Steel pegged 2024 global steel consumption would total at 1.75 billion, which would be the third consecutive year of declining demand for the industry. That forecast revised downward the outlook issued earlier this year, citing continuing weak activity in manufacturing and industrial sectors around the world, as well as the political instability in some markets, ongoing regional conflicts.

The forecast for 2025 is not entirely encouraging, predicting that steel consumption will grow 1.2% year-over-year in the 12 months to come.

The most persistent factor shaping global steel production is domestic demand in China – which in any particular month produces well more than half of all the world's raw steel. For the full 12 months of 2024, Chinese steelmakers produced 1.005 billion metric tons, about 55% of the total global output. Such volumes have made China a force in international steel trade for the past two decades, and its role as exporter of steel has become more problematic for the rest of the world as China’s domestic market has endured weak manufacturing demand and a severe slowdown in construction activity.

Chinese regulators’ efforts to overcome weak domestic demand by exporting more have been ongoing, following government regulators’ long program to eliminate excessive and inefficient steelmaking capacity there.

The past decade has seen surging production in India, which is firmly set now as the world’s second-largest steelmaking nation. Indian steelmakers produced 149.6 million last year, 6.3% more than the 2023 total. In contrast to the leading producer nations in other regions, India’s industry maintained consistently improving volumes from month to month throughout 2024.

Traditionally large steelmaking industries in Japan and U.S. proceeded through 2024 in a very disciplined manner, incrementally adding or cutting monthly volumes according to domestic or regional demand. In Japan, total 2024 raw-steel output was 84.0 million metric tons, -3.4% lower than in 2023.

With December’s expected smaller – 6.7 million metric tons (7.4 million short tons) – the U.S. steel industry’s 12-month total output for 2024 was 79.5 million metric tons (87.6 million short tons), a -2.4% drop from the 2023 result. It was third consecutive year for falling steel output by the U.S. industry.

Elsewhere, the somewhat isolated Russian steel industry had an estimated 70.7 million metric tons of output during 2024, down -7.0% from 2023.

South Korean steelmakers produced 63.5 million metric tons from January to December 2024, a -4.7% decrease from the previous 12-month period.

The European Union (which includes major producing nations in Germany, Italy, and France), had a total output of 129.5 million metric tons in 2024, a 2.6% improvement from the year earlier. And Germany alone produced 37.2 million metric tons of raw steel in 2024, a 5.2% improvement over 2023.