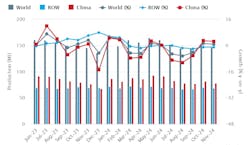

Raw steel production fell to 146.8 million metric tons worldwide during November 2024, down -3.61% from October and up just 0.8% from November 2023, as steelmakers work to avoid over-production against consistently weak demand.

World Steel Association reports the monthly totals for raw steel production in 71 nations, specifically for carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. Specialty and stainless steel volumes are not included.

In October, World Steel forecast 2024 global steel consumption would total at 1.75 billion, which would be the third consecutive year of declining demand for the industry. That forecast revised downward the outlook issued earlier this year, citing continuing weak activity in manufacturing and industrial sectors around the world, as well as the political instability in some markets, ongoing regional conflicts.

The forecast for 2025 is not entirely encouraging, predicting that global steel consumption will grow just 1.2% year-over-year in the 12 months to come.

November results brought year-to-date raw-steel production to 1.69 billion metric tons, slightly less (-1.4%) than the January-November total for 2023 – and indicating that in major steel-producing markets producers are carefully curtailing output to meet apparent demand.

The largest steelmaking nation, China, produced 78.4 million metric tons during November, a drop-off of -4.46% from October but still 2.5% higher than last November’s total. For the current year-to-date, Chinese steelmakers have produced 929.2 million metric tons, which is -2.7% less than their January-November 2023 result.

India’s steel industry has been an outlier from the global trend, and so although the 12.4 million metric tons produced there during November show a -0.81% decrease from October, the total is 4.5% higher than November 2023. For January-November, Indian steel output has totaled 135.9 million metric tons, 5.9% more than during the comparable period of 2023.

In Japan, November steel production remained unchanged from October at 6.9 million metric tons. That signals a -3.1% decrease from November 2023, and it brings YTD raw steel production to 77.1 million metric tons, -3.6% less than last year’s 11-month total.

The U.S. is the world’s fourth-largest producer of steel, and the 6.4 million metric tons (7.05 million short tons) meant a -3.1% decrease from October and a -2.8% decrease from November 2023. For January-November 2024, U.S. steelmakers have produced 72.9 million metric tons (80.36 million short tons) of raw steel, -2.2% less than they produced for the first eleven months of 2023.

Elsewhere, World Steel estimated that Russia’s steel industry produced 5.5 million metric tons during November, which would be a -1.2% month/month decrease and a -9.2% year/year decrease. The YTD output is estimated at 64.9 million metric tons, a -7.0% decrease.

In South Korea, the November total for raw steel output was 5.2 million metric tons, -3.8% less than in October and -3.6% less than November 2023. The 11-month total for 2024 is 58.3 million metric tons, a decrease of -4.9% from 2023.

The German steel industry produced 2.9 million metric tons of raw steel during November, -10.3% less than in October, and yet 8.6% more than in November 2023. Germany’s YTD raw-steel output is 34.5 million metric tons, a 5.3% improvement from 2023.

Across the European Union (27 nations, including Germany), raw steel production totaled 10.7 million metric tons, 3.9% more than November 2023. The region’s January-November steel output stands at 119.9 million metric tons, 2.2% above the total output for the comparable period of 2023.