Cutting Tool Orders Now Even with 2023

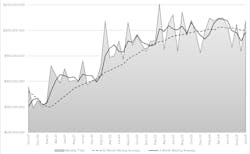

Purchases of cutting tools by U.S. manufacturers and machine shops totaled $212.5 million, rising 12.6% from September but showing almost no improvement (up just 0.2%) over the October 2023 result. The month-over-month increase followed a -10.0% drop from August to September, and through 10 months of 2024 activity, cutting tool consumption totals $2.07 billion, or just 0.6% more than the comparable result for January-October 2023.

According to Steve Stokey, executive vice president and owner of Allied Machine and Engineering, “The data indicates what most of us realize, and that is the economy continues to be soft.”

Cutting tool orders, as documented in the monthly Cutting Tool Market Report, are a relevant indicator of overall manufacturing activity because of the wide range of manufacturing sectors served by cutting-tool buyers.

The numbers are drawn from the latest edition of the CTMR, issued by USCTI and AMT - the Assn. for Manufacturing Technology. CTMR is a monthly summary of shipments made by companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable.

“Orders for cutting tools in the United States have slowed significantly as we approach the final months of 2024,” stated USCTI president Steve Boyer, president of USCTI. “Four of the last five months have seen lower numbers compared to the same period last year.

“Several factors have contributed to this decline, including uncertainty in the political landscape, work stoppages at major cutting tool users, and ongoing challenges with high interest rates,” he continued.

But Stokey pointed to economic forecasts showing “we are at the bottom of the curve, and better times are ahead. The upturn cannot come soon enough.”

Boyer also observed “some optimism for the future, with upcoming projects in large industries planned for 2025 and a modest decrease in interest rates already observed.”