Steep Drop in Machine Tool Orders

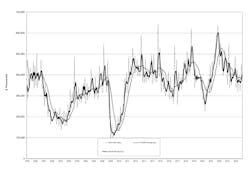

U.S. manufacturers’ orders for new machine tools and other metalworking units fell -14.5% from a very strong September showing to finish October at $385 million. That new total also falls -5.5% lower than the October 2023 new-order total, and it means that the year-to-date total for 2024 new orders is $3.74 billion, -7.5% lower than the January-October total for 2023.

The data is provided by AMT - the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report, a monthly summary of purchases of metal-cutting machinery and metal-forming and fabricating machinery nationwide, and in six regions.

USMTO data also serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

AMT noted warily that the Federal Reserve Bank’s September decision to lower interest rates has not improved the average order value, compared to the previous expansionary period. This may indicate the hoped for “soft landing” has not developed, meaning the possibility of an economic recession remains – as the order volumes suggest the U.S. economy has not demonstrated a transition from ‘growth’ to slow or no growth, which the Fed has tried to maneuver over recent quarters.

Although the September USMTO report included 2024’s highest monthly order level, and was 5.1% higher than the average September order volume, AMT noted that the October order volume continues a “longer-term downward trend” that is a result of a normalization of order activity following manufacturers’ response to rising demand and supply constraints during the Covid pandemic.

However, the new October 2024 total ranges 3% higher than the average October order volume, despite a sharp decline in orders by contract machine shops, the so-called job shop operations that had boosted orders in preceding months. AMT suggested that the contract machine shops reduced their orders in October due to uncertainty about the outcome of the U.S. presidential election, as well as the disruption in manufacturing activity due to the International Assn. of Machinists strike that continued from mid-September into November.

In contrast, October saw increased order volumes from manufacturers of aerospace products and parts; in fact, those operations posted their highest level for any month this year. The implication is that during the strike-imposed downtime, aerospace manufacturers replaced and/or updated their production equipment.

The results from the six territories covered by USMTO showed that only the West region delivered a month-to-month increase (+4.8%) in orders for October; the Northeast (-31.3%) and North Central-West (-25.8%) fared the worst among the others.

Only the North Central-West (+18.5%) and West (+7.0%) posted positive year-over-year improvements in October order volume, and only the West (+13.8%) region is currently ahead of 2023 for its year-to-date order totals.