Machine Tool Demand is Stalled, Suppliers Group Reports

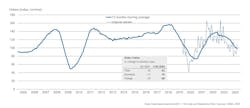

Machine tool demand fell -16% year-over-year during the third quarter of 2024, according to an economic summary issued by the trade group representing the German industry. That result combines with a -17% drop in domestic (German) orders and -15% fall in export orders.

The German Machine Tool Builders’ Assn. (VDW) represents the world’s third-largest machine-tool manufacturing sector, with a net turnover of €15.4 billion ($16.5 billion) in 2023, and 64% of its products exported to markets in Europe and worldwide. It is among the largest segments in that country’s mechanical engineering industry, and it employs about 65,250 people.

Through nine months of 2024 activity, the VDW records that new orders are -23% lower than during the January-September 2023 period, with domestic orders down -10% and exports orders -28% versus the nine-month 2023 results.

While totals for U.S. machine tool orders have been reported only through August, demand in the domestic (U.S.) market is somewhat better, down -11.5% compared with the January-August 2023 order total.

With the release of the U.S. Bureau of Economic Analysis’ GDP estimate for Q3 2024 showing a 2.8% annual growth rate, Assn. for Manufacturing Technology (AMT) principal economist Christopher Chidzik commented: "We can see the strength of the sectors dependent on the metalworking machinery that AMT members build and sell, with capital goods (excluding automotive) driving both imports and exports in Q3.

“Personal consumption expenditure continued its meteoric post-COVID climb, rising at 8.1%, exceeding growth in the general economy. Similarly, business investment in equipment grew at 11.1%, indicating continued need for capacity across business sectors,” the AMT economist added.

Across the Atlantic, the outlook is less optimistic. "The order situation remains challenging," stated Dr. Markus Heering, executive director of VDW, commenting on the German result.

In Germany, industrial activity was steady through three quarters of 2024, but that has not overcome machine tool buyers’ hesitancy to invest in capital equipment. "In general,” Heering said, “domestic customers are very unsettled and are unwilling to invest."

That hesitancy extends German machine tool builders’ regional European customers. Demand from Asia is the weakest during the period, while orders from the U.S. and Mexico have sustained demand for VDW companies.

"We have seen little change in the state of the industry since the first half of the year," Heering said. "The stream of news coming from the automotive industry is giving cause for concern. And overall business levels are down across the board, both in the markets and in the customer industries. A number of major projects from the aerospace, medical technology, energy, shipbuilding, and defense sectors are helping.”

VDW companies’ services, components, maintenance, and conversion activities are outperforming their new machine business, and automation remains an important driver of machine tool investments.

The Association reported that surveys of its member companies indicate that 45% of them plan to reintroduce shorter work schedules in the weeks to come – up from 35% in VDW’s 2Q survey.

It further noted that some manufacturers plan to reduce the numbers of temporary workers.