Global Steel Output Drops for Fourth Straight Month

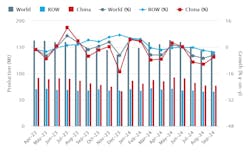

Global steel production fell for the fourth consecutive month in September, down 1.2 million tons or -0.8% from August to 143. 6 million metric tons across 71 countries worldwide. The new total reported by the World Steel Association brings global year-to-date raw steel production to 1.39 billion metric tons, or -4.7% less than the September 2023 total, and -1.9% less than the January-September 2023 total.

The steady decline in 2024 output is an apparent a response to persistent global inflation and its effects on manufacturing and construction activity. In World Steel’s recent report on short-range demand for global steel consumption, it lowered the forecast from its April report, now predicting that 2024 consumption will decline to 1.75 billion. That will mean this will be the third consecutive year of declining global steel consumption.

World Steel Association tracks monthly output for “raw steel,” meaning carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. Specialty and stainless steel volumes are not included.

The outsized influence of the Chinese industry on the global steel economy is a major factor shaping overall conditions. That country typically produces more than half of the world’s total raw-steel output. Weak domestic steel demand (due to slower manufacturing and a moribund real-estate sector), plus continued overcapacity in its domestic steel industry, have caused a surge in China’s steel exports to surge; reportedly, Chinese exports are on track for up to 100 million metric tons this year.

During September, Chinese steelmaker produced 77.1 million metric tons of raw steel, down -1.0% from August and -6.1% from September 2023. Through nine months of 2024 production, China’s steelmaking is down -3.3% from last year.

Indian steelmakers produced 11.7 million metric tons during September, -5.1% less than in August but nearly even (-0.2%) with September 2023. Their YTD raw-steel output is up 6.5% versus the comparable nine months of last year.

In Japan, September steel production of 6.6 million metric tons was down -4.55% from August and down -5.8% from September 2023. Japan’s 10-month production volume is 63.3 million metric tons, or -2.9% less than during January-September 2023.

U.S. raw steel production totaled 6.7 million metric tons (7.4 million short tons) during September, -4.48% from August but 1.2% higher than the September 2023. For the January-September period, the U.S. industry has produced 60.3 million metric tons (66.5 million short tons) of raw steel, or -1.7% less than last year after nine months of production.

Elsewhere, the estimated output of Russian steelmakers for September was 5.6 million metric tons, a -10.3% decrease versus September 2023, and with 54 million metric tons produced YTD that country is -5.5% below its 2023 volume.

South Korean steelmakers produced 5.5 million metric tons during September, 1.3% more than last September – but their 48.1 million metric tons produced since January have them at -4.6% less than last year’s nine-month result.

Steelmakers across the 27 nations of the European Union produce 10.5 million metric tons during September, about even (+0.3%) with September 2023, and their 97.8 million metric tons produced during January through September have them 1.5% ahead of last year.

The largest producer nation in the EU, Germany, posted 3.0 million metric tons of output during September, 4.3% higher than last September. That brings this year’s total to 28.4 million metric tons, 4.0% ahead of January-September 2023 for the German producers.