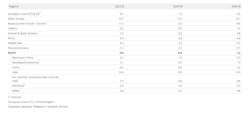

Global steel consumption is now forecast to decline to 1.75 billion metric tons for 2024, or about 12 million metric tons below actual global consumption for 2023, as multiple factors continue to impair economic growth worldwide. The new forecast by the World Steel Association revises the April 2024 consumption total by -0.9%, but it maintains the outlook for steel consumption growth (1.2%) in 2025.

“2024 has been a difficult year for global steel demand as the global manufacturing sector continued to grapple with persistent headwinds, such as declining household purchasing power, aggressive monetary tightening, and escalating geopolitical uncertainties,” explained Dr. Martin Theuringer, managing director of the German Steel Assn. and chairman of the World Steel Economics Committee. “The ongoing weakness in housing construction, which is driven by tight financing conditions and high costs, has further contributed to the sluggish demand for steel.”

World Steel Economics issues semi-annual Short Range Outlook reports for global steel demand, addressing regional and market factors shaping steel consumption. The new Outlook concludes that the global steel industry faces a third consecutive year of falling demand.

As China is the by far the largest steelmaking nation, the poor rate of steel consumption there is among the prevailing factors dragging a rebound worldwide. World Steel identified the continuing decline of China’s real-estate market as the cause of a -3.0% drop in forecast 2024 steel demand there, and a further -1.0% drop in Chinese demand for 2025. “We acknowledge an upside risk to our 2025 forecast,” the group offered. ‘There is a growing possibility of more substantial government intervention and support for the real economy, which could bolster Chinese steel demand in 2025,” it added.

Steel demand among developing nations other than China is forecast to grow 3.5% this year, and 4.2% in 2025. An important factor in this growth continues to be India, where consumption is seen growing 8.0% this year, and 8.5% in 2025.

Steel demand in other emerging economies (e.g., MENA and ASEAN regions) slowed during 2022-23, but now such markets are forecast for recovery in 2024.

Some developed markets – the United States, Japan, Korea, and Germany – are forecast to deliver significant decreases in steel demand for 2024, but then regain growth prospects in 2025, based on a strong revival of .

The developed world is projected to experience a 2.0% decrease in steel demand in 2024, as major steel-using economies like the US, Japan, Korea and Germany face significant declines. However, there is optimism for 2025, with a projected growth of 1.9% in developed world steel demand. This anticipated recovery is driven by the long-awaited upturn in steel demand in the EU, and modest recoveries in the US and Japan.

Among the individual consuming markets, World Steel Economics identifies “persistent weakness in global manufacturing activity” as a factor slowing demand recovery. “Our earlier projection of a continued recovery in global manufacturing activity in 2024 has not materialized. Instead, the sector experienced a downturn in the third quarter, diverging from the initial growth observed in the first months of the year and the positive signals from leading indicators. We observed that a significant contributor to the manufacturing slowdown is the ongoing reluctance of households and businesses to invest in durable goods… The lingering effects of the past three years of inflation have eroded the purchasing power of many middle- and lower-income families, further dampening demand for manufactured goods.”

The forecasters also cited the slowdown in housing construction that began in 2023 and continues now, though they expect this segment to recover in 2025 as financing conditions improve.

Automotive steel demand will suffer in 2024 as that industry is set to record a “significant slowdown.” The forecasters expect modest growth in global light vehicle production in 2025.

The World Steel report observes that strong investments in manufacturing plants and public infrastructure have underpinned global steel demand throughout 2023 and into 2024, and major economies have sustained growth in these areas over that period. Looking ahead, rising construction costs, labor shortages, and mounting debt may limit further growth in this economic segment in the near term.

Lastly, World Steel identifies the “green transition of the world economy” as a major driver for public infrastructure investments, and notes that expanding global electricity grids may comprise demand for approximately 20 million metric tons per year by 2030 (from the current 10 million metric tons per year.)

“We estimate that expanding global renewable energy generation capacity and connecting it to demand centers will necessitate a steel demand increase of approximately 40 million metric tons by the end of the decade,” according to the report. “This is likely to give quite a noticeable support to overall steel demand in both major developing economies such as China and India, and developed economies, especially Europe and North America.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.