Cutting-Tool Spending Falling in 2024

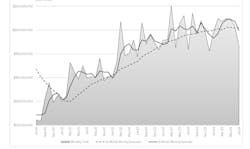

U.S. manufacturers’ demand for cutting tools fell -7.8% from June to July, or $191.8 million, while still managing to remain slightly above (1.7%) the demand total recorded for July 2023. The new figure brings the 2024 year-to-date cutting-tool consumption total to $1.46 billion, which is 2.5% higher than the January-July total for 2023.

"July is typically a slower month, but overall, the curve has flattened out," offered AMT Cutting Tool Product Group chairman Jack Burley.

AMT - the Assn. for Manufacturing Technology, along with the U.S. Cutting Tool Institute reported the totals in their latest Cutting Tool Market Report, a monthly summary of shipments made by companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable.

Because of the wide range of activities represented by cutting-tool buyers, the CTMR is considered a relevant indicator of overall manufacturing activity.

"Commercial aerospace and automotive production have leveled off, and this has a direct impact on cutting tool consumption and new orders. As we near the end of the third quarter, I expect shipments of cutting tools to continue to trend as they have so far this year,” Burley added.

CTMR totals have declined for three consecutive months, including the July result. As such, the slowing rate of consumption is indicative of the pace of manufacturing activity in the weeks prior the Federal Reserve Bank decision to cut short-term lending rates, on September 18.

That development, following the International Manufacturing Technology Show recently completed in mid-September – an event that typically spurs high levels of investment in capital equipment and consumable products like cutting tools – could shape manufacturers’ spending in the remaining months of 2024.

AMT’s Burly expressed optimism that IMTS would “provide the necessary boost to our shipments for a positive end to 2024.”

"Manufacturing production typically slows during the summer months, but it is concerning to see the year-on-year growth in cutting-tool shipments continue the decline that began in April,” observed Tom Haag, president at Kyocera SGS Precision Tool. “If we consider inflation and price increases, I see the current year as flat.”

Haag continued: “Looking forward, the current Boeing strike could add additional headwinds. However, there is an expectation that lower interest rates and the IMTS exhibition will generate new investment to counter this slowing manufacturing output."