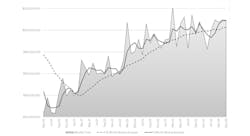

U.S. machine shops and other manufacturers purchased $214.4 million worth of cutting tools during May 2024, slightly more (0.1%) than their April purchases, and 1.8% more than the May 2023 purchases value. The new data raises the total for 2024 cutting tool shipments to $1.06 billion, 4.0% above the total for shipments during January-May 2023.

“May’s results indicate that production levels remain strong, but I think the historically high numbers can be somewhat attributed to inflation,” according to Jack Burley, chairman of AMT’s Cutting Tool Product Group.

“Backlogs are coming down, and most job shops are no longer working overtime, but they’re still dependent on the core customer base they support,” Burley continued. “A side benefit is that shops now have time to test new products and work on process improvements rather than focusing on hitting their shipments every week.”

AMT - the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute jointly present the monthly Cutting Tool Market Report, from which the shipment totals are drawn. The CTMR summarizes shipments made by companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable. Their demand for cutting tools closely matches U.S. durable goods shipments as a measure of overall industrial activity.