Cutting Tool Orders on the Edge

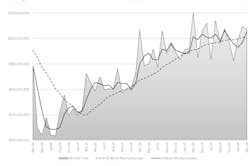

U.S. manufacturing activity slipped -1.1% from February to March according to the Cutting Tool Market Report – a monthly index of cutting tool purchases that reflects operating levels across a wide spectrum of industries, comparable to U.S. durable goods shipments. The latest report finds cutting tool consumption at $212.4 million during March, which is -5.8% lower than the March 2023 total.

Through three months of activity this year, 2024 cutting-tool consumption totals $631.5 million, or 2.0% higher than last year’s January-March total.

“The first quarter of 2024 is up slightly over the first quarter of 2023, but the long-run trend has turned negative for the first time since March 2021, when the industry began to recover from the COVID-19 downturn,” according to Steve Stokey, EVP and owner Allied Machine and Engineering.

“Stubbornly high inflation appears to be a drag on the (cutting tool) industry as the number of units shipped has shown a more sluggish trend than the value of shipments,” Stokey added. “The remainder of the year could end flat or slightly down from 2023 if these patterns continue.”

The monthly CTMR is issued by AMT - the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute.

Cutting-tool purchases are a marker of overall manufacturing activity because those purchases reflect production across a range of manufacturing market segments served by machining operations. Data in the report summarizes purchases by companies participating in the CTMR program who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable. Their demand for cutting tools closely matches U.S. durable goods shipments as a measure of production activity.

“Despite the troubles at Boeing, cutting tool shipments to aerospace and defense-related manufacturing remain quite strong,” observed AMT Cutting Tool Product Group chairman Jack Burley. “First-quarter data indicates that consumption of cutting tools and tooling remains on pace with current industrial production at a modest level. This may be an indicator of somewhat sluggish activity.”

Burley continued: “New projects are available in most industries, but many customers are reluctant to move forward, possibly because they are worried about inflation and election results. Despite the downward trend in new machine tool orders, I find it very interesting that cutting tools and related accessories to keep shops running are still performing reasonably well.”