Automakers Still Lead Demand for Automation

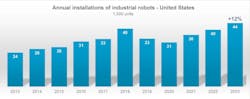

According to the International Federation of Robotics, U.S. manufacturers’ installations of industrial robots totaled 44,303 units during 2023, up 12.0% from the year before. The automotive industry led all other sectors in the number of new robot installations, followed by the electrical and electronics industry.

“The United States has one of the most advanced manufacturing industries worldwide,” stated IFR president Marina Bill. “The first IFR outlook on preliminary results shows again strong robotics demand across all major segments of U.S. manufacturing in 2023.”

Robot sales to the automotive industry increased 1.0% over 2022, with a record number of 14,678 robots installed from January through December 2023. The rise follows a 47.0% year/year increase last year, with a total of 14,472 units installed.

“Automotive manufacturers currently invest in robotics mainly to drive the electric vehicle transition and respond to labor shortages,” according to Marina Bill.

IFR noted that the market share for automakers and auto-parts manufacturers hit 33% of all industrial robot installations in the U.S. last year, noting that the U.S. auto industry had the world’s second-largest production volume for cars and light trucks during 2023.

In the electrical and electronics industry, new robot installations increased by 37% from 2022 to 5,120 units last year. That number approached the electronics sector’s pre-pandemic record level of 5,284 units, from 2018.

The new result for 2023 demand in electronics production represents a market share of 12% of all industrial robots installed by U.S. manufacturers, IFR noted. The group added that U.S. demand for industrial robots in this segment is influenced by a trend to strengthen domestic supply chains and projects that drive the clean-energy transition.

Other U.S. manufacturing sectors recording heavy demand for robotics in 2023 (i.e., more than 3,000 units installed) included metal and machinery (4,123 units, +6%) and plastic and chemical products (3,213 units, +5%). They represent a market share of 9% and 7% of industrial robot installations in 2023, respectively.

Outside the U.S., robot installations rose 43.0% year-over-year in Canada during 2023, or 4,616 units. The Canadian automotive industry represented 55% of the country´s robot installations last year, an increase of 99.0% over the previous year, with an all-time-high 2,549 units installed.

Robot installations by Mexican manufacturers were flat during 2023, with 5,868 units in 2023. Mexican automotive manufacturers accounted for 69% of all robot installations in the country last year. Total Mexican robot sales amounted to 4,068 units in 2023, well off the peak of 4,805 robots for 2017.