Steel Output Lagging Year-Ago Pace

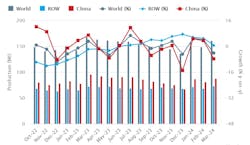

Global raw-steel production rose to 161.2 million metric tons during March, nearly 8.0% higher than the February total but still -4.3% less than the March 2023 tonnage. The new result reported by the World Steel Assn. brings 2024 raw steel output to 469.1 million metric tons, roughly even (+0.4%) with last year’s January-to-March production volume.

World Steel represents the individual industries of 71 nations, who comprise 97.0% of global raw-steel capacity. Its monthly report covers carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. (Specialty and stainless steel volumes are not included.)

Recently World Steel issued a semi-annual short-term outlook for global steel consumption, forecasting a +1.7% rise in demand for 2024 to 1.793 billion metric tons, about 19 million metric tons less than was forecast in a comparable study issued six months ago. That report also foresees steel demand growing by just 1.2% in 2025, to 1.815 billion metric tons. That would be 34 million metric tons below the forecast amount from October 2023.

The weakness in steel demand continues to stem from ongoing slowness in industrial activity in Asia and the European Union, and lagging construction activity worldwide. Both factors are a consequence of high interest rates and general uncertainty in international affairs.

The March tonnage results confirm the weakness in demand, but the -4.3% year-over-year drop is apparently the result of sustained output cuts in the Chinese industry. China’s steelmakers comprise about half of the world’s installed raw-steel capacity, and while their 88.3 million metric tons produced during March represents about 58.0% of the global steel output last month, it is a -7.8% drop from China’s March 2023 total.

For the current year to-date, Chinese steelmakers have produced 256.6 million metric tons, -1.9% less than they produced during January-March 2023.

India, the world’s second-largest steel industry, produced 12.7 million metric tons during March, 7.1% more than during February and 7.8% more than during March 2023. During January-March, Indian steelmakers produce 37.3 million metric tons, which is 9.7% more than during the comparable period of last year.

In Japan, March raw steel production totaled 7.2 million metric tons, 2.8% more than the February result but -3.9% less than during March 2023. Their year-to-date tonnage output is 21.5 million metric tons, basically even (-0.8%) with last year’s first three months’ total.

As in Japan, steelmakers in the United States have curbed their output to match demand. For March, U.S. steelmakers produced 6.9 million metric tons (7.6 million short tons), which is 5.8% more than during the shorter month of February, and shows no change from the March 2023 result.

For the first three months of 2024, U.S. steel production totaled 19.9 million metric tons (20.9 million short tons), or -1.6% less than the volume produced during January-March 2023.